Asked by Jarrin Goecke on Jun 15, 2024

Verified

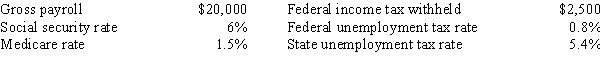

Perez Company has the following information for the pay period of January 15-31.  Assuming no employees are subject to ceilings for their earnings, calculate salaries payable and employer payroll tax expense.

Assuming no employees are subject to ceilings for their earnings, calculate salaries payable and employer payroll tax expense.

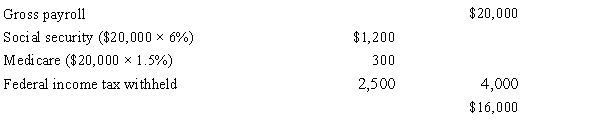

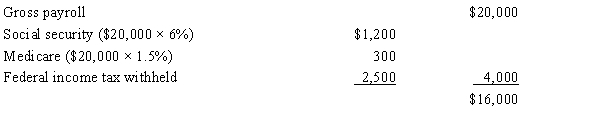

Salaries Payable

An account containing the total amount of salary expense that has been incurred by a company but has not yet been paid out to employees.

Employer Payroll Tax Expense

Taxes paid by employers based on the salary and wages of employees, including social security and Medicare taxes in the United States, among others.

- Understand the methodologies involved in accounting for payroll, specifically the calculation of take-home pay, withholdings, and the tax liabilities of employers.

- Determine employer payroll tax obligations by applying designated tax rates to payroll figures.

Verified Answer

RS

Learning Objectives

- Understand the methodologies involved in accounting for payroll, specifically the calculation of take-home pay, withholdings, and the tax liabilities of employers.

- Determine employer payroll tax obligations by applying designated tax rates to payroll figures.

Related questions

The Following Information Is for Employee Ella Dodd for the ...

Baker Green's Weekly Gross Earnings for the Week Ending December ...

An Employee Receives an Hourly Rate of $45, with Time ...

An Employee Earned $4,600 in February Working for an Employer ...

Gross Earnings Minus Total Deductions Equal ________ Earnings

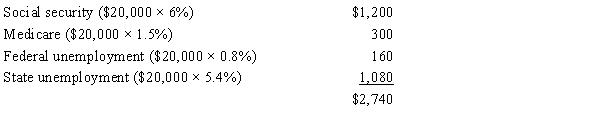

Employer payroll tax expense:

Employer payroll tax expense: