Asked by Katherine Lupercio on May 01, 2024

Verified

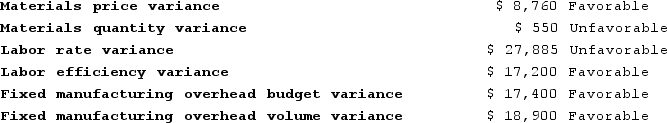

Woodhead Incorporated manufactures one product. It does not maintain any beginning or ending inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. Its standard cost per unit produced is $37.45. During the year, the company produced and sold 24,400 units at a price of $47.40 per unit and its selling and administrative expenses totaled $92,000. The company does not have any variable manufacturing overhead costs. It recorded the following variances during the year:  The net operating income for the year is closest to:

The net operating income for the year is closest to:

A) $259,859

B) $184,605

C) $151,026

D) $150,780

Standard Cost

The planned cost for a unit of product or service, serving as a benchmark for evaluating performance and setting budgets.

Net Operating Income

The profit a company makes after deducting its operating expenses, without accounting for taxes and interest.

Selling And Administrative Expenses

These are expenses that are not directly tied to the production of goods or services, including costs such as salaries of sales personnel and marketing expenses.

- Understand the method for transferring standard cost variances to the Cost of Goods Sold.

Verified Answer

ZK

Zybrea KnightMay 06, 2024

Final Answer :

B

Explanation :

Calculation of operating income:

Sales revenue = 24,400 x $47.40 = $1,155,360

Cost of goods sold:

Standard cost = 24,400 x $37.45 = $914,180

Direct materials price variance = (24,400 x $1.50) - $36,500 = $1,820 F

Direct materials efficiency variance = (24,400 x 0.8 hours x $12.00) - $189,600 = $20,736 U

Direct labor rate variance = (24,400 x $0.50) - $12,200 = $610 F

Direct labor efficiency variance = (24,400 x 1.5 hours x $12.00) - $526,500 = $3,300 U

Total variance = $24,646 U

Actual cost of goods sold = $914,180 + $24,646 = $938,826

Gross margin = $1,155,360 - $938,826 = $216,534

Selling and administrative expenses = $92,000

Operating income = $216,534 - $92,000 = $124,534

Therefore, the net operating income for the year is closest to $184,605.

Sales revenue = 24,400 x $47.40 = $1,155,360

Cost of goods sold:

Standard cost = 24,400 x $37.45 = $914,180

Direct materials price variance = (24,400 x $1.50) - $36,500 = $1,820 F

Direct materials efficiency variance = (24,400 x 0.8 hours x $12.00) - $189,600 = $20,736 U

Direct labor rate variance = (24,400 x $0.50) - $12,200 = $610 F

Direct labor efficiency variance = (24,400 x 1.5 hours x $12.00) - $526,500 = $3,300 U

Total variance = $24,646 U

Actual cost of goods sold = $914,180 + $24,646 = $938,826

Gross margin = $1,155,360 - $938,826 = $216,534

Selling and administrative expenses = $92,000

Operating income = $216,534 - $92,000 = $124,534

Therefore, the net operating income for the year is closest to $184,605.

Learning Objectives

- Understand the method for transferring standard cost variances to the Cost of Goods Sold.