Asked by Selia Bennett on Apr 24, 2024

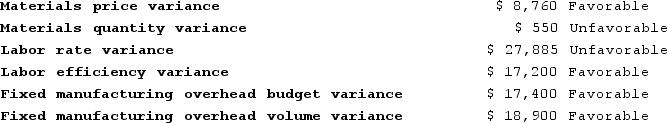

Woodhead Incorporated manufactures one product. It does not maintain any beginning or ending inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. Its standard cost per unit produced is $37.45. During the year, the company produced and sold 24,400 units at a price of $47.40 per unit and its selling and administrative expenses totaled $92,000. The company does not have any variable manufacturing overhead costs. It recorded the following variances during the year:  When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:

When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:

A) ($36,300)

B) $33,825

C) ($33,825)

D) $36,300

Standard Cost Variances

The differences between the actual costs incurred and the standard costs set for producing a good or service.

Cost Of Goods Sold

The total cost directly associated with producing goods that have been sold, including materials, labor, and manufacturing overhead.

- Learn the technique for adjusting standard cost variances to the Cost of Goods Sold.

Learning Objectives

- Learn the technique for adjusting standard cost variances to the Cost of Goods Sold.