Asked by Osvaldo Munoz on Apr 29, 2024

Verified

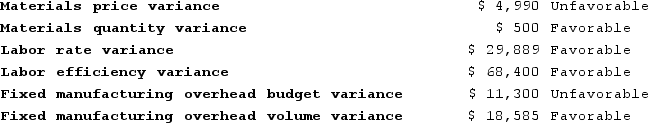

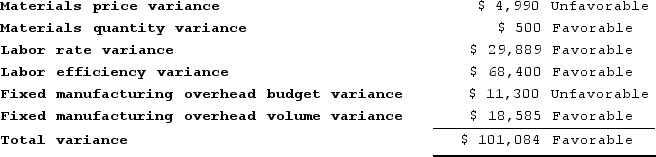

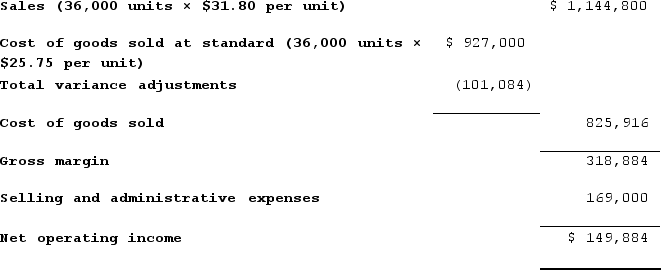

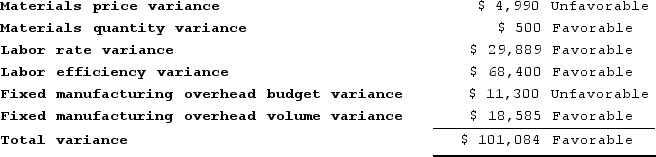

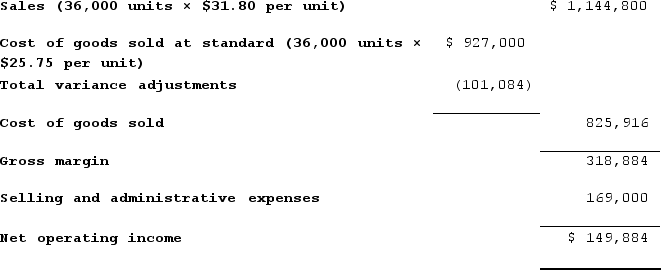

Bascom Incorporated manufactures one product. It does not maintain any beginning or ending inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. Its standard cost per unit produced is $25.75. During the year, the company produced and sold 36,000 units at a price of $31.80 per unit and its selling and administrative expenses totaled $169,000. The company does not have any variable manufacturing overhead costs. It recorded the following variances during the year:

Required:1. When the company closes its standard cost variances, the cost of goods sold will increase (decrease) by how much?2. Prepare an income statement for the year.

Required:1. When the company closes its standard cost variances, the cost of goods sold will increase (decrease) by how much?2. Prepare an income statement for the year.

Standard Cost Variances

The differences between the expected (standard) costs of a product and the actual costs incurred.

Cost of Goods Sold

The overall expenses involved in creating or purchasing goods sold in a given timeframe, consisting of the cost of materials, workforce, and indirect costs.

Standard Cost

A set cost for producing either one unit or multiple units of a product within a defined timeframe, based on existing or expected operational circumstances.

- Cultivate the skill to identify variances in budgeted versus actual costs, pertaining to direct materials, direct labor, and fixed overhead expenses.

- Master the technique of creating and analyzing financial statements specific to manufacturing sectors by applying standard costing principles.

- Become proficient in applying standard cost variances to Cost of Goods Sold.

Verified Answer

ZK

Zybrea KnightMay 06, 2024

Final Answer :

1.

An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.2.

An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.2.

An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.2.

An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.2.

Learning Objectives

- Cultivate the skill to identify variances in budgeted versus actual costs, pertaining to direct materials, direct labor, and fixed overhead expenses.

- Master the technique of creating and analyzing financial statements specific to manufacturing sectors by applying standard costing principles.

- Become proficient in applying standard cost variances to Cost of Goods Sold.