Asked by Jonathan Ghansiam on May 06, 2024

Verified

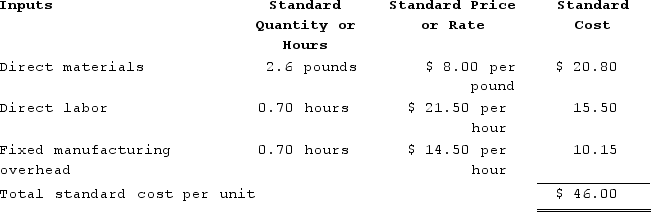

Trundle Corporation manufactures one product. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

During the year, the company completed the following transactions concerning raw materials:a. Purchased 99,100 pounds of raw material at a price of $7.90 per pound.b. Used 89,020 pounds of the raw material to produce 34,200 units of work in process.

During the year, the company completed the following transactions concerning raw materials:a. Purchased 99,100 pounds of raw material at a price of $7.90 per pound.b. Used 89,020 pounds of the raw material to produce 34,200 units of work in process.

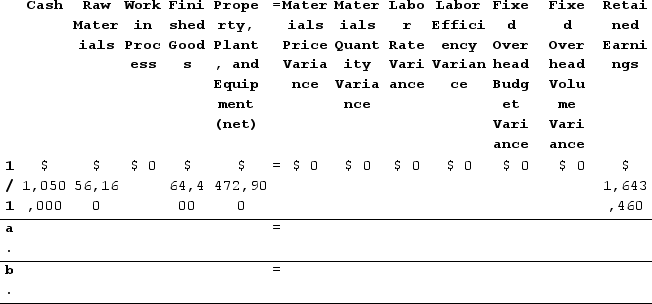

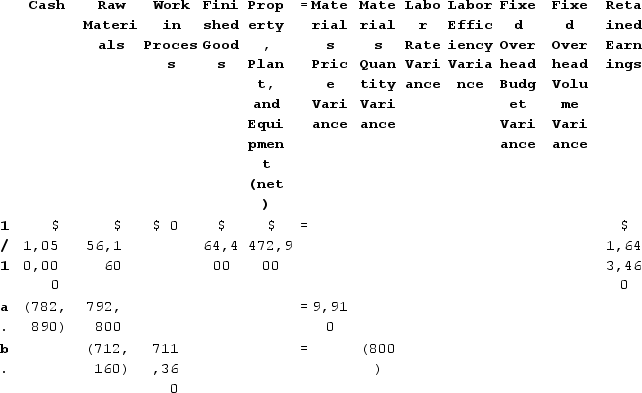

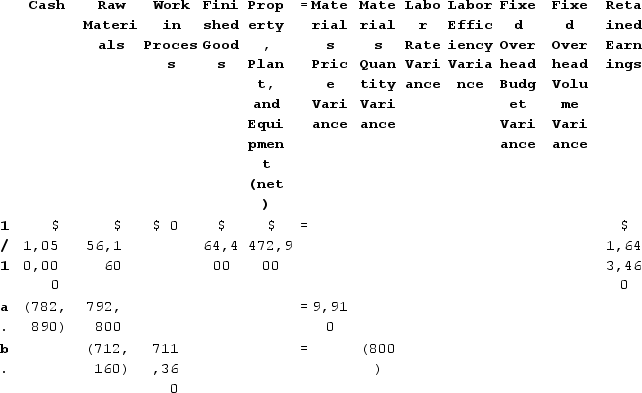

Required:Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

Standard Cost

An estimated or predetermined cost of performing an operation or producing a good, used in budgeting and pricing decisions.

Raw Material

Basic materials used in the production process as inputs to create finished goods.

Work in Process

Items that are in the middle stages of production, neither raw materials nor finished goods, reflecting the cost of ongoing manufacturing activities.

- Become proficient in and apply the standard costing concept in the context of manufacturing operations.

Verified Answer

SP

suresh parajuliMay 12, 2024

Final Answer :

Materials price variance = Actual quantity × (Average price − Standard price)= 99,100 pounds × ($7.90 per pound − $8.00 per pound)= 99,100 pounds × (−$0.10 per pound)= $9,910 Favorable

Materials quantity variance:Standard quantity = Actual output × Standard quantity = 34,200 units × 2.6 pounds per unit = 88,920 poundsMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= (89,020 pounds − 88,920 pounds) × $8.00 per pound= (100 pounds) × $8.00 per pound= $800 Unfavorable

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 99,100 pounds × $7.90 per pound = $782,890. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 99,100 pounds × $8.00 per pound = $792,800. The materials price variance is $9,910 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 89,020 pounds × $8.00 per pound = $712,160. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (34,200 units × 2.6 pounds per unit) × $8.00 per pound = 88,920 pounds × $8.00 per pound = $711,360. The difference is the Materials Quantity Variance which is $800 Unfavorable.

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 99,100 pounds × $7.90 per pound = $782,890. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 99,100 pounds × $8.00 per pound = $792,800. The materials price variance is $9,910 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 89,020 pounds × $8.00 per pound = $712,160. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (34,200 units × 2.6 pounds per unit) × $8.00 per pound = 88,920 pounds × $8.00 per pound = $711,360. The difference is the Materials Quantity Variance which is $800 Unfavorable.

Materials quantity variance:Standard quantity = Actual output × Standard quantity = 34,200 units × 2.6 pounds per unit = 88,920 poundsMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= (89,020 pounds − 88,920 pounds) × $8.00 per pound= (100 pounds) × $8.00 per pound= $800 Unfavorable

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 99,100 pounds × $7.90 per pound = $782,890. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 99,100 pounds × $8.00 per pound = $792,800. The materials price variance is $9,910 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 89,020 pounds × $8.00 per pound = $712,160. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (34,200 units × 2.6 pounds per unit) × $8.00 per pound = 88,920 pounds × $8.00 per pound = $711,360. The difference is the Materials Quantity Variance which is $800 Unfavorable.

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 99,100 pounds × $7.90 per pound = $782,890. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 99,100 pounds × $8.00 per pound = $792,800. The materials price variance is $9,910 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 89,020 pounds × $8.00 per pound = $712,160. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (34,200 units × 2.6 pounds per unit) × $8.00 per pound = 88,920 pounds × $8.00 per pound = $711,360. The difference is the Materials Quantity Variance which is $800 Unfavorable.

Learning Objectives

- Become proficient in and apply the standard costing concept in the context of manufacturing operations.