Asked by Felicia Rioza on May 21, 2024

Verified

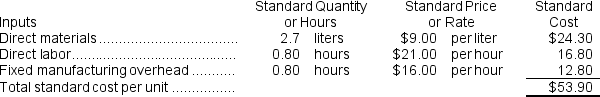

Obenshain Corporation manufactures one product.The company uses a standard cost system in which inventories are recorded at their standard costs.The standard cost card for the company's only product is as follows:  During the year, direct labor workers (who were paid in cash)worked 12,880 hours at an average cost of $20.00 per hour on 17,600 units.These units were started and completed during the year.

During the year, direct labor workers (who were paid in cash)worked 12,880 hours at an average cost of $20.00 per hour on 17,600 units.These units were started and completed during the year.

Required:

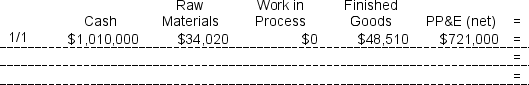

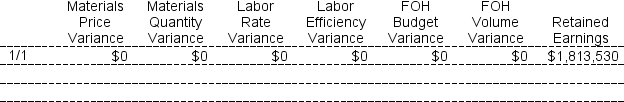

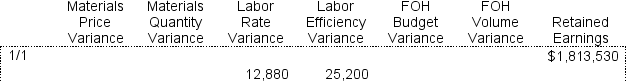

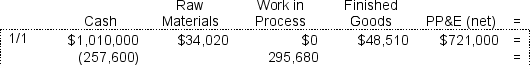

Completely record the direct labor costs, along with any direct labor variances, in the below worksheet.Because of the width of the worksheet, it is in two parts.In your text, these two parts would be joined side-by-side to make one very wide worksheet.The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net)account which is abbreviated as PP&E (net).

Direct Labor Variances

The difference between the actual and standard labor costs incurred by a business during a specific period.

Direct Labor Costs

The wages and benefits paid for labor that is directly involved in the production of goods.

Property, Plant, and Equipment

Long-term tangible assets that a company uses in its operations and that are expected to provide benefits for more than one year.

- Learn and administer the principles of standard costing in manufacturing operations.

- Process and examine differences in direct labor financial figures.

- Register financial exchanges using an established cost accounting system.

Verified Answer

CB

Chase BrauchieMay 24, 2024

Final Answer :

Labor rate variance = AH × (AR - SR)

= 12,880 hours × ($20.00 per hour - $21.00 per hour)

= 12,880 hours × (-$1.00 per hour)

= $12,880 F

Labor efficiency variance:

SH = Actual output × Standard quantity = 17,600 units × 0.80 hours per unit = 14,080 hours

Labor efficiency variance = (AH - SH)× SR

= (12,880 hours - 14,080 hours)× $21.00 per hour

= (-1,200 hours)× $21.00 per hour

= $25,200 F

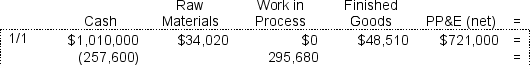

Cash decreases by the actual amount paid to direct laborers, which is AH × AR = 12,880 hours × $20.00 per hour = $257,600.Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is SH × SR = (17,600 units × 0.80 hours per unit)× $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680.The difference consists of the Labor Rate Variance which is $12,880 F and the Labor Efficiency Variance which is $25,200 F.

Cash decreases by the actual amount paid to direct laborers, which is AH × AR = 12,880 hours × $20.00 per hour = $257,600.Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is SH × SR = (17,600 units × 0.80 hours per unit)× $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680.The difference consists of the Labor Rate Variance which is $12,880 F and the Labor Efficiency Variance which is $25,200 F.

= 12,880 hours × ($20.00 per hour - $21.00 per hour)

= 12,880 hours × (-$1.00 per hour)

= $12,880 F

Labor efficiency variance:

SH = Actual output × Standard quantity = 17,600 units × 0.80 hours per unit = 14,080 hours

Labor efficiency variance = (AH - SH)× SR

= (12,880 hours - 14,080 hours)× $21.00 per hour

= (-1,200 hours)× $21.00 per hour

= $25,200 F

Cash decreases by the actual amount paid to direct laborers, which is AH × AR = 12,880 hours × $20.00 per hour = $257,600.Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is SH × SR = (17,600 units × 0.80 hours per unit)× $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680.The difference consists of the Labor Rate Variance which is $12,880 F and the Labor Efficiency Variance which is $25,200 F.

Cash decreases by the actual amount paid to direct laborers, which is AH × AR = 12,880 hours × $20.00 per hour = $257,600.Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is SH × SR = (17,600 units × 0.80 hours per unit)× $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680.The difference consists of the Labor Rate Variance which is $12,880 F and the Labor Efficiency Variance which is $25,200 F.

Learning Objectives

- Learn and administer the principles of standard costing in manufacturing operations.

- Process and examine differences in direct labor financial figures.

- Register financial exchanges using an established cost accounting system.