Asked by callie torres on May 01, 2024

Verified

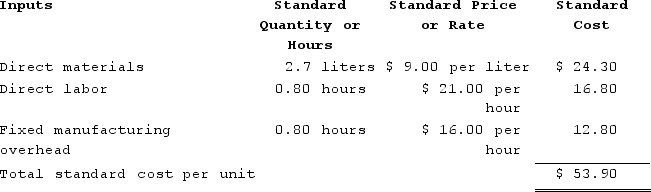

Obenshain Corporation manufactures one product. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows:

During the year, direct labor workers (who were paid in cash) worked 12,880 hours at an average cost of $20.00 per hour on 17,600 units. These units were started and completed during the year.

During the year, direct labor workers (who were paid in cash) worked 12,880 hours at an average cost of $20.00 per hour on 17,600 units. These units were started and completed during the year.

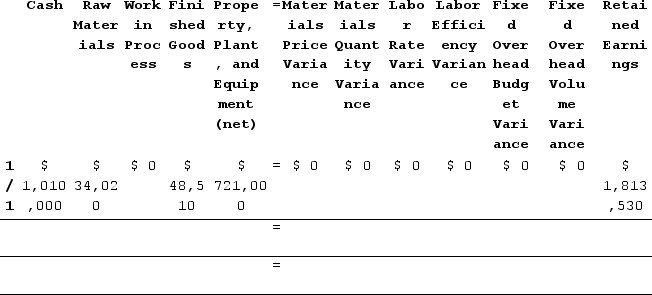

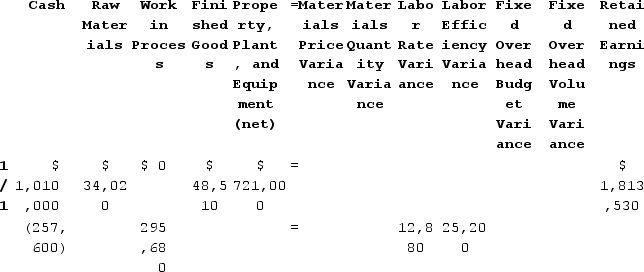

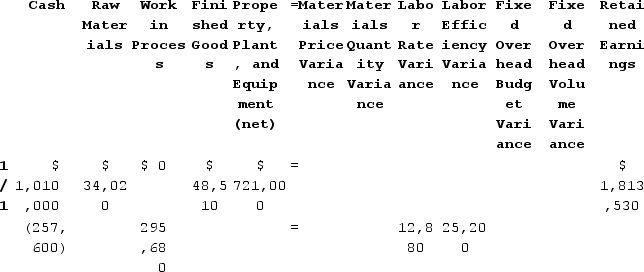

Required:Completely record the direct labor costs, along with any direct labor variances, in the below worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

Standard Cost

A predetermined cost of manufacturing a single unit or a number of product units during a specific period under current or anticipated operating conditions.

Direct Labor Variances

The differences between the actual costs of direct labor and the standard or expected costs, used for budgeting and cost control.

Direct Labor Workers

Employees who are directly involved in the production of goods or services.

- Master and enact the theory of standard costing in the sphere of manufacturing procedures.

- Appraise the fiscal effects of standard compared with actual costs in manufacturing operations.

Verified Answer

JM

juan manuel echeverry muñozMay 07, 2024

Final Answer :

Labor rate variance = Actual hours × (Actual rate − Standard rate)= 12,880 hours × ($20.00 per hour − $21.00 per hour)= 12,880 hours × (−$1.00 per hour)= $12,880 FavorableLabor efficiency variance:Standard hours = Actual output × Standard quantity = 17,600 units × 0.80 hours per unit = 14,080 hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= (12,880 hours − 14,080 hours) × $21.00 per hour= (−1,200 hours) × $21.00 per hour= $25,200 Favorable

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 12,880 hours × $20.00 per hour = $257,600. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (17,600 units × 0.80 hours per unit) × $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680. The difference consists of the Labor Rate Variance which is $12,880 Favorable and the Labor Efficiency Variance which is $25,200 Favorable.

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 12,880 hours × $20.00 per hour = $257,600. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (17,600 units × 0.80 hours per unit) × $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680. The difference consists of the Labor Rate Variance which is $12,880 Favorable and the Labor Efficiency Variance which is $25,200 Favorable.

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 12,880 hours × $20.00 per hour = $257,600. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (17,600 units × 0.80 hours per unit) × $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680. The difference consists of the Labor Rate Variance which is $12,880 Favorable and the Labor Efficiency Variance which is $25,200 Favorable.

Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 12,880 hours × $20.00 per hour = $257,600. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (17,600 units × 0.80 hours per unit) × $21.00 per hour = 14,080 hours × $21.00 per hour = $295,680. The difference consists of the Labor Rate Variance which is $12,880 Favorable and the Labor Efficiency Variance which is $25,200 Favorable.

Learning Objectives

- Master and enact the theory of standard costing in the sphere of manufacturing procedures.

- Appraise the fiscal effects of standard compared with actual costs in manufacturing operations.