Asked by Cameron Brown on Jun 12, 2024

Verified

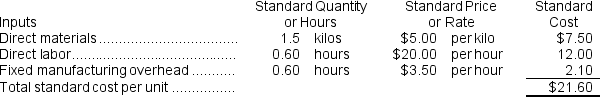

Siciliano Corporation manufactures one product.The company uses a standard cost system in which inventories are recorded at their standard costs.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:  During the year, the company completed the following transactions concerning raw materials:

During the year, the company completed the following transactions concerning raw materials:

a.Purchased 34,800 kilos of raw material at a price of $4.60 per kilo.

b.Used 32,750 kilos of the raw material to produce 21,900 units of work in process.

Required:

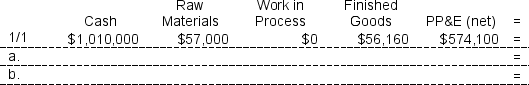

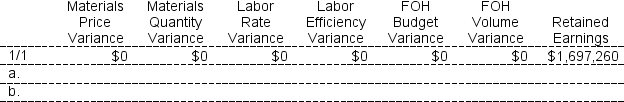

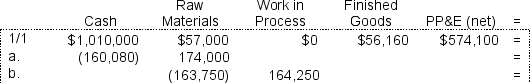

Record the above transactions in the worksheet that appears below.Because of the width of the worksheet, it is in two parts.In your text, these two parts would be joined side-by-side to make one very wide worksheet.The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net)account which is abbreviated as PP&E (net).

Raw Material

The basic material from which a product is made, typically unprocessed or minimally processed before being used in production.

Work in Process

The inventory account that records products in production but not yet completed.

Property, Plant, and Equipment

Long-term tangible assets owned by a business that are used in producing goods or providing services.

- Cultivate an understanding of and utilize the principles of standard costing in industrial production.

- Execute analysis and computation on discrepancies of direct materials.

- Transcribe monetary exchanges employing an established cost accounting framework.

Verified Answer

JL

Janneth LopezJun 12, 2024

Final Answer :

Materials price variance = AQ × (AP - SP)

= 34,800 kilos × ($4.60 per kilo - $5.00 per kilo)

= 34,800 kilos × (-$0.40 per kilo)

= $13,920 F

Materials quantity variance:

SQ = Actual output × Standard quantity = 21,900 units × 1.5 kilos per unit = 32,850 kilos

Materials quantity variance = (AQ - SQ)× SP

= (32,750 kilos - 32,850 kilos)× $5.00 per kilo

= (-100 kilos)× $5.00 per kilo

= $500 F

The explanations are as follows:

The explanations are as follows:

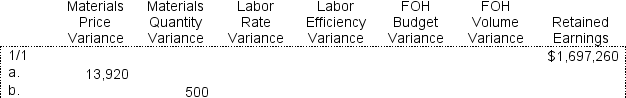

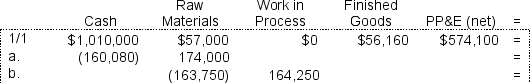

a.Cash decreases by the actual cost of the raw materials purchased, which is AQ × AP = 34,800 kilos × $4.60 per kilo = $160,080.Raw Materials increase by the standard cost of the raw materials purchased, which is AQ × SP = 34,800 kilos × $5.00 per kilo = $174,000.The materials price variance is $13,920 F.

b.Raw Materials decrease by the standard cost of the raw materials used in production, which is AQ × SP = 32,750 kilos × $5.00 per kilo = $163,750.Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is SQ × SP = (21,900 units × 1.5 kilos per unit)× $5.00 per kilo = 32,850 kilos × $5.00 per kilo = $164,250.The difference is the Materials Quantity Variance which is $500 F.

= 34,800 kilos × ($4.60 per kilo - $5.00 per kilo)

= 34,800 kilos × (-$0.40 per kilo)

= $13,920 F

Materials quantity variance:

SQ = Actual output × Standard quantity = 21,900 units × 1.5 kilos per unit = 32,850 kilos

Materials quantity variance = (AQ - SQ)× SP

= (32,750 kilos - 32,850 kilos)× $5.00 per kilo

= (-100 kilos)× $5.00 per kilo

= $500 F

The explanations are as follows:

The explanations are as follows:a.Cash decreases by the actual cost of the raw materials purchased, which is AQ × AP = 34,800 kilos × $4.60 per kilo = $160,080.Raw Materials increase by the standard cost of the raw materials purchased, which is AQ × SP = 34,800 kilos × $5.00 per kilo = $174,000.The materials price variance is $13,920 F.

b.Raw Materials decrease by the standard cost of the raw materials used in production, which is AQ × SP = 32,750 kilos × $5.00 per kilo = $163,750.Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is SQ × SP = (21,900 units × 1.5 kilos per unit)× $5.00 per kilo = 32,850 kilos × $5.00 per kilo = $164,250.The difference is the Materials Quantity Variance which is $500 F.

Learning Objectives

- Cultivate an understanding of and utilize the principles of standard costing in industrial production.

- Execute analysis and computation on discrepancies of direct materials.

- Transcribe monetary exchanges employing an established cost accounting framework.