Asked by Carlos Murray on Jun 03, 2024

Verified

The unit product cost under variable costing in Year 1 is closest to:

A) $20.00

B) $26.00

C) $46.00

D) $40.00

Variable Costing

An accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in the cost of goods sold and treats fixed manufacturing overhead as a period cost.

Year 1

Often refers to the first year of a business or financial operation, used as a baseline for comparing future performance or growth.

- Evaluate the unit product cost utilizing variable and absorption costing methodologies.

Verified Answer

MH

Mahdi HasanJun 08, 2024

Final Answer :

A

Explanation :

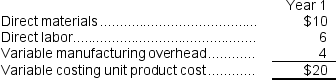

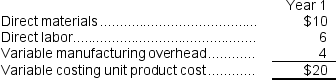

Under variable costing, only variable costs are included in the calculation of unit product cost. Therefore, the unit product cost in Year 1 is calculated as follows:

Direct materials per unit + Direct labor per unit + Variable manufacturing overhead per unit

= $8.00 + $5.00 + $7.00

= $20.00

Therefore, the best choice is A, as it gives the correct unit product cost for Year 1 under variable costing.

Direct materials per unit + Direct labor per unit + Variable manufacturing overhead per unit

= $8.00 + $5.00 + $7.00

= $20.00

Therefore, the best choice is A, as it gives the correct unit product cost for Year 1 under variable costing.

Explanation :

Variable costing unit product costs:

Learning Objectives

- Evaluate the unit product cost utilizing variable and absorption costing methodologies.

Related questions

The Unit Product Cost Under Absorption Costing in Year 1 ...

The Unit Product Cost Under Variable Costing in Year 1 ...

Shelko Corporation Manufactures and Sells One Product ...

Lefelmann Corporation, Which Has Only One Product, Has Provided the ...

Pacheo Corporation, Which Has Only One Product, Has Provided the ...