Asked by Selia Bennett on May 07, 2024

Verified

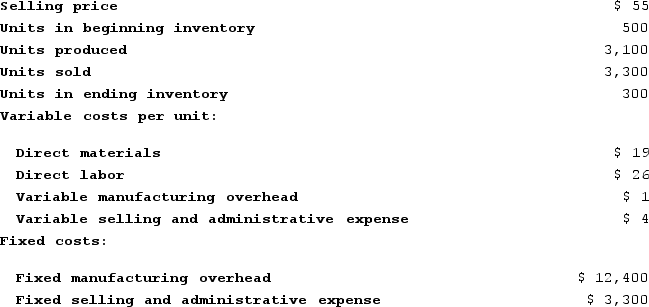

Pacheo Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. Prepare a contribution format income statement for the month using variable costing.c. Without preparing an income statement, determine the absorption costing net operating income for the month.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. Prepare a contribution format income statement for the month using variable costing.c. Without preparing an income statement, determine the absorption costing net operating income for the month.

Variable Costing

A bookkeeping approach that incorporates solely the variable costs of production (such as direct materials, direct labor, and variable manufacturing overhead) into the cost of goods sold while omitting fixed manufacturing overhead.

Contribution Format

A method of organizing the income statement where variable expenses are deducted from sales to show the contribution margin, highlighting the variable costs and fixed costs separately.

Income Statement

A financial document that provides an overview of a company's performance over a specific period, detailing revenues, expenses, and net earnings.

- Get acquainted with the foundational principles of variable and absorption costing.

- Ascertain the pricing per unit under the variable and absorption cost determination methods.

- Arrange income statements drawing on variable and absorption costing.

Verified Answer

SL

Shelley LutovMay 13, 2024

Final Answer :

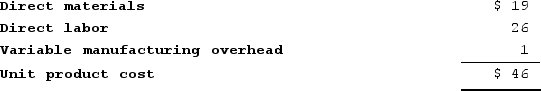

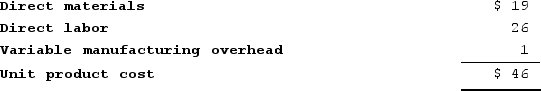

a.Variable costing unit product cost

b.Variable costing income statement

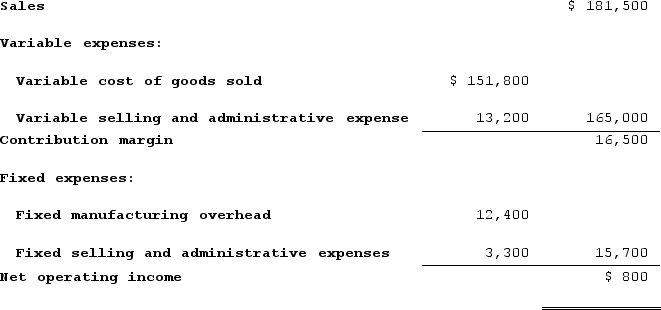

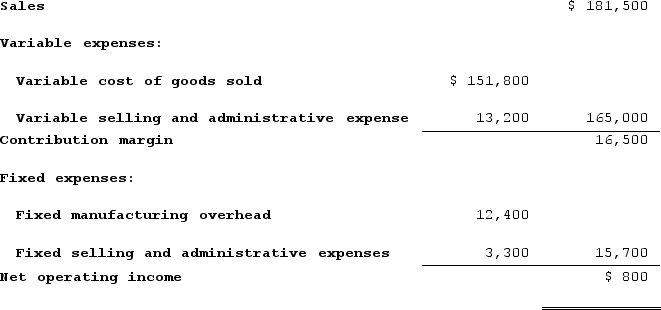

b.Variable costing income statement

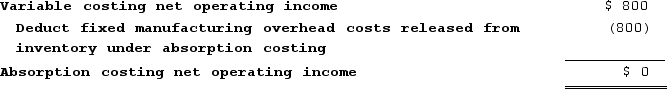

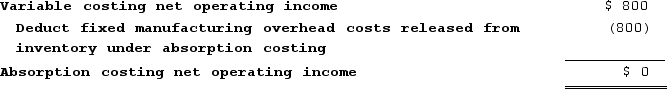

c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

b.Variable costing income statement

b.Variable costing income statement c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

Learning Objectives

- Get acquainted with the foundational principles of variable and absorption costing.

- Ascertain the pricing per unit under the variable and absorption cost determination methods.

- Arrange income statements drawing on variable and absorption costing.