Asked by richard chiem on May 07, 2024

Verified

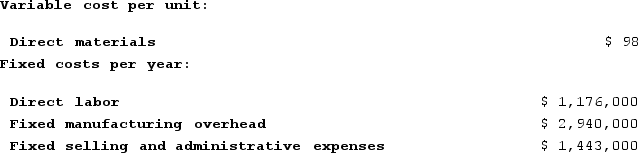

Shelko Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.b. Assume that the company uses an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.c. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Absorption Costing

An accounting method where all manufacturing costs, including both fixed and variable costs, are allocated to produced units.

Direct Labor Cost

The total cost of wages paid to workers directly involved in manufacturing a product or delivering a service.

Fixed Manufacturing Overhead

The total of all manufacturing costs that do not vary with the level of production, such as rent, salaries, and insurance.

- Acquire insight into the principles of variable and absorption costing.

- Assess unit product costs via variable and absorption costing tactics.

- Design income statements applying variable and absorption costing practices.

Verified Answer

SB

Sarah BelwayMay 08, 2024

Final Answer :

a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement:

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_8699_bf83_f9763a0e3e94_TB8314_00.jpg) b.Absorption costing unit product cost:

b.Absorption costing unit product cost:

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869a_bf83_5b0d8b07f83f_TB8314_00.jpg) Absorption costing income statement:

Absorption costing income statement:

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869b_bf83_d1aae94ecbe8_TB8314_00.jpg) c.Reconciliation of super-variable costing and absorption costing net incomes:

c.Reconciliation of super-variable costing and absorption costing net incomes:

Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_adac_bf83_eb6419928f9a_TB8314_00.jpg)

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_8699_bf83_f9763a0e3e94_TB8314_00.jpg) b.Absorption costing unit product cost:

b.Absorption costing unit product cost:![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869a_bf83_5b0d8b07f83f_TB8314_00.jpg) Absorption costing income statement:

Absorption costing income statement:![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_869b_bf83_d1aae94ecbe8_TB8314_00.jpg) c.Reconciliation of super-variable costing and absorption costing net incomes:

c.Reconciliation of super-variable costing and absorption costing net incomes:Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000

![a.Under super-variable costing, the unit product cost is just the direct materials cost of $98 per unit.Super-variable costing income statement: b.Absorption costing unit product cost: Absorption costing income statement: c.Reconciliation of super-variable costing and absorption costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 42,000 units − 37,000 units = 5,000 unitsDirect labor and fixed manufacturing overhead cost deferred in (released from) inventory = Direct labor and fixed manufacturing overhead cost in ending inventory − Direct labor and fixed manufacturing overhead cost in beginning inventory = [($28 per unit + $70 per unit) × 5,000 units] − $0 = $490,000](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61ca_adac_bf83_eb6419928f9a_TB8314_00.jpg)

Learning Objectives

- Acquire insight into the principles of variable and absorption costing.

- Assess unit product costs via variable and absorption costing tactics.

- Design income statements applying variable and absorption costing practices.