Asked by Fateh Singh on Jun 28, 2024

Verified

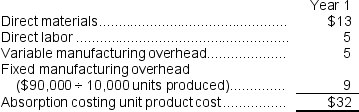

The unit product cost under absorption costing in Year 1 is closest to:

A) $38.00

B) $32.00

C) $23.00

D) $9.00

Absorption Costing

An accounting method that includes all manufacturing costs, both variable and fixed, in the cost of a product, and is used for external reporting purposes.

Unit Product Cost

The total cost associated with manufacturing one unit of a product, including labor, materials, and overhead expenses.

Year 1

A term typically used to refer to the first year of operation, accounting period, or investment.

- Estimate the cost per unit in accordance with variable and absorption costing strategies.

Verified Answer

Therefore, the manufacturing overhead cost per unit is $24.00 ($240,000 ÷ 10,000 units).

Adding this to the sum of direct materials and direct labor per unit ($8 + $0), the unit product cost under absorption costing in Year 1 is $32.00.

Learning Objectives

- Estimate the cost per unit in accordance with variable and absorption costing strategies.

Related questions

The Unit Product Cost Under Variable Costing in Year 1 ...

The Unit Product Cost Under Variable Costing in Year 1 ...

Shelko Corporation Manufactures and Sells One Product ...

Lefelmann Corporation, Which Has Only One Product, Has Provided the ...

Pacheo Corporation, Which Has Only One Product, Has Provided the ...