Asked by Alyssa Squissato on Jun 12, 2024

Verified

The simple rate of return would be closest to:

A) 30.0%

B) 17.5%

C) 18.75%

D) 12.5%

Simple Rate

The percentage increase or interest rate in a financial calculation, often straightforward or uncomplicated.

- Elucidate the principle of the simple rate of return and its application in assessing the performance of investments.

Verified Answer

TW

Tonika WitchardJun 19, 2024

Final Answer :

C

Explanation :

Simple rate of return is calculated by dividing the increase in value (gross profit) by the initial investment. In this case, the gross profit is $375,000 and the initial investment is $2,000,000. So, the simple rate of return is 18.75%.

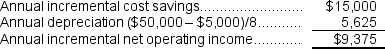

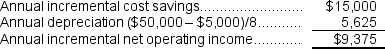

Explanation :  Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment

= $9,375 ÷ $50,000 = 18.75%

Reference: CH12-Ref6

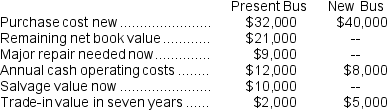

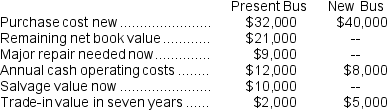

(Ignore income taxes in this problem.)Morrel University has a small shuttle bus that is in poor mechanical condition.The bus can be either overhauled now or replaced with a new shuttle bus.The following data have been gathered concerning these two alternatives: The University could continue to use the present bus for the next seven years.Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years.The University uses a discount rate of 12% and the total cost approach to net present value analysis.

The University could continue to use the present bus for the next seven years.Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years.The University uses a discount rate of 12% and the total cost approach to net present value analysis.

Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment= $9,375 ÷ $50,000 = 18.75%

Reference: CH12-Ref6

(Ignore income taxes in this problem.)Morrel University has a small shuttle bus that is in poor mechanical condition.The bus can be either overhauled now or replaced with a new shuttle bus.The following data have been gathered concerning these two alternatives:

The University could continue to use the present bus for the next seven years.Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years.The University uses a discount rate of 12% and the total cost approach to net present value analysis.

The University could continue to use the present bus for the next seven years.Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years.The University uses a discount rate of 12% and the total cost approach to net present value analysis.

Learning Objectives

- Elucidate the principle of the simple rate of return and its application in assessing the performance of investments.