Asked by Austin Collins on Jun 13, 2024

Verified

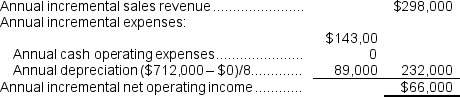

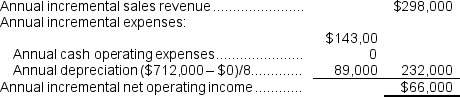

(Ignore income taxes in this problem.) Slomkowski Corporation is contemplating purchasing equipment that would increase sales revenues by $298,000 per year and cash operating expenses by $143,000 per year.The equipment would cost $712,000 and have a 8 year life with no salvage value.The annual depreciation would be $89,000.The simple rate of return on the investment is closest to:

A) 9.3%

B) 21.8%

C) 22.1%

D) 12.5%

Cash Operating Expenses

Costs directly associated with the operation of a business that require cash payment, excluding non-cash expenses such as depreciation.

Simple Rate

A term not commonly used in a standard context, possibly referring to a basic interest rate in financial terms.

Salvage Value

The estimated resale value of an asset at the end of its useful life, used in calculating depreciation expenses.

- Detail the principle of the simple rate of return and its implementation in examining investment performance.

Verified Answer

KA

Kishen AnathamJun 14, 2024

Final Answer :

A

Explanation :  Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment

= $66,000 ÷ $712,000 = 9.3% (rounded)

Reference: CH12-Ref1

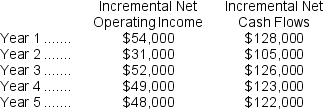

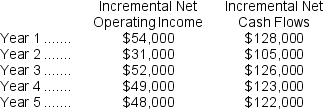

(Ignore income taxes in this problem.)Vandezande Inc.is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are: Assume cash flows occur uniformly throughout a year except for the initial investment.

Assume cash flows occur uniformly throughout a year except for the initial investment.

Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment= $66,000 ÷ $712,000 = 9.3% (rounded)

Reference: CH12-Ref1

(Ignore income taxes in this problem.)Vandezande Inc.is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

Assume cash flows occur uniformly throughout a year except for the initial investment.

Assume cash flows occur uniformly throughout a year except for the initial investment.

Learning Objectives

- Detail the principle of the simple rate of return and its implementation in examining investment performance.