Asked by Manmeet Sanger on May 14, 2024

Verified

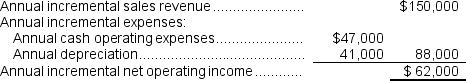

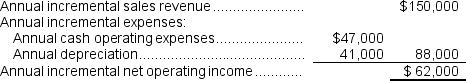

(Ignore income taxes in this problem.) An expansion at Fey, Inc., would increase sales revenues by $150,000 per year and cash operating expenses by $47,000 per year.The initial investment would be for equipment that would cost $328,000 and have a 8 year life with no salvage value.The annual depreciation on the equipment would be $41,000.The simple rate of return on the investment is closest to:

A) 41.3%

B) 18.9%

C) 12.5%

D) 31.4%

Sales Revenues

The total amount of money generated from the sale of goods or services before any costs or expenses are deducted.

Cash Operating Expenses

The expenses a company incurs during its day-to-day operational activities, paid in cash, such as rent, utilities, and salary payments.

Simple Rate

A basic or straightforward interest rate calculation without compounding, often used in financial transactions and loan agreements.

- Articulate the idea of the simple rate of return and its utility in gauging the success of investments.

Verified Answer

TW

Travis WoernerMay 19, 2024

Final Answer :

B

Explanation :  Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment

= $62,000 ÷ $328,000 = 18.9% (rounded)

Simple rate of return = Annual incremental net operating income ÷ Initial investment

Simple rate of return = Annual incremental net operating income ÷ Initial investment= $62,000 ÷ $328,000 = 18.9% (rounded)

Learning Objectives

- Articulate the idea of the simple rate of return and its utility in gauging the success of investments.