Asked by Clara J. Gomez on Jun 20, 2024

Verified

The overhead applied to each unit of Product G1 under activity-based costing is closest to:

A) $780.12 per unit

B) $866.76 per unit

C) $830.79 per unit

D) $380.33 per unit

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to specific products or services based on the activities that contribute to these costs.

Overhead

The indirect costs of running a business that cannot be directly linked to a specific product or service, such as utilities, rent, and administrative expenses.

- Work out and contrast the expenses for unit products under traditional versus activity-based costing.

- Analyze the difference in overhead allocation between traditional costing and ABC.

Verified Answer

JS

jakub szadyJun 21, 2024

Final Answer :

C

Explanation :

The overhead cost for each activity is calculated as follows:

- Activity 1: $345,000 / 1,500 = $230 per setup

- Activity 2: $375,000 / 12,500 = $30 per machine hour

- Activity 3: $480,000 / 20,000 = $24 per inspection

- Activity 4: $590,000 / 40,000 = $14.75 per order

Total overhead cost per unit of G1 = ($230 + $30 x 6 + $24 + $14.75 x 3) / 1,000 = $0.83 per unit

Therefore, the closest option is C, which is $830.79 per unit.

- Activity 1: $345,000 / 1,500 = $230 per setup

- Activity 2: $375,000 / 12,500 = $30 per machine hour

- Activity 3: $480,000 / 20,000 = $24 per inspection

- Activity 4: $590,000 / 40,000 = $14.75 per order

Total overhead cost per unit of G1 = ($230 + $30 x 6 + $24 + $14.75 x 3) / 1,000 = $0.83 per unit

Therefore, the closest option is C, which is $830.79 per unit.

Explanation :

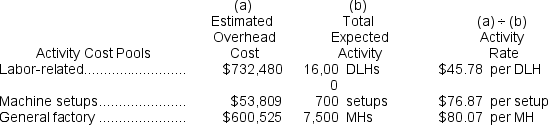

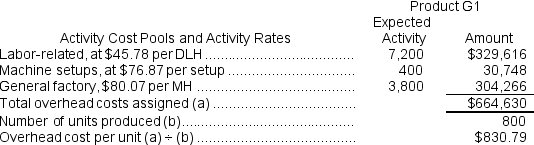

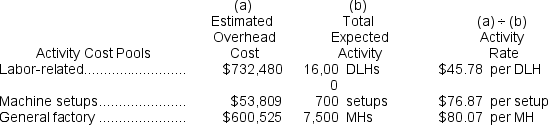

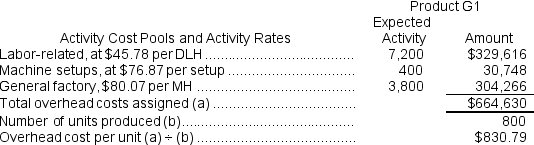

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Essay

Essay

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Essay

Essay

Learning Objectives

- Work out and contrast the expenses for unit products under traditional versus activity-based costing.

- Analyze the difference in overhead allocation between traditional costing and ABC.