Asked by Briana Robinson on Jun 18, 2024

Verified

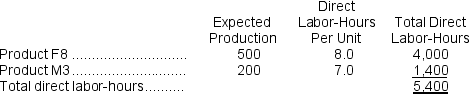

Cazier, Inc., manufactures and sells two products: Product F8 and Product M3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $19.30 per DLH.The direct materials cost per unit is $204.50 for Product F8 and $199.90 for Product M3.

The direct labor rate is $19.30 per DLH.The direct materials cost per unit is $204.50 for Product F8 and $199.90 for Product M3.

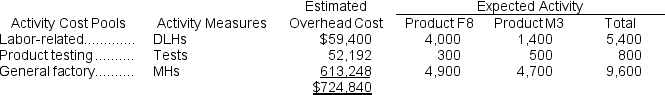

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

Determine the unit product cost of each product under the activity-based costing method.

Activity-Based Costing

A costing method that assigns costs to products and services based on the activities they require.

Direct Labor-Hours

Cumulative working time of employees who are directly engaged in producing goods.

Direct Materials Cost

The cost of raw materials that can be directly traced to the production of goods.

- Evaluate and juxtapose per unit costs under traditional versus activity-based costing methodologies.

Verified Answer

MP

Maria PegueroJun 20, 2024

Final Answer :

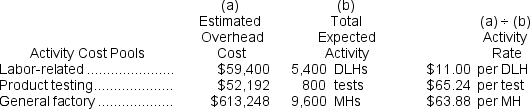

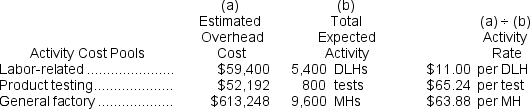

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

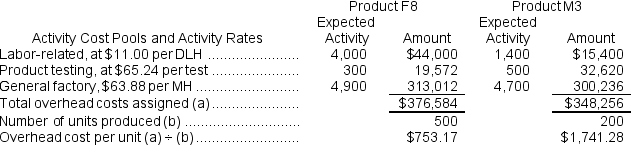

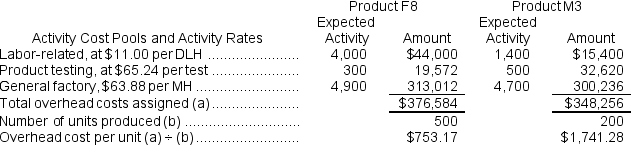

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

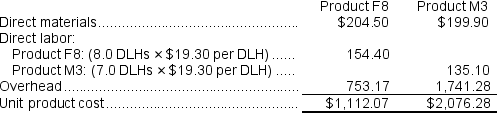

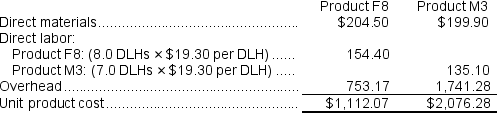

Computation of unit product costs under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

Computation of unit product costs under activity-based costing.

Learning Objectives

- Evaluate and juxtapose per unit costs under traditional versus activity-based costing methodologies.