Asked by Shibuya Daemon on Jun 19, 2024

Verified

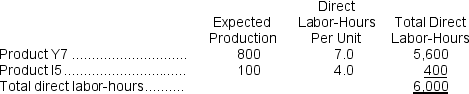

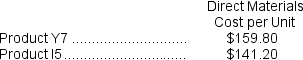

Dooms, Inc., manufactures and sells two products: Product Y7 and Product I5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:

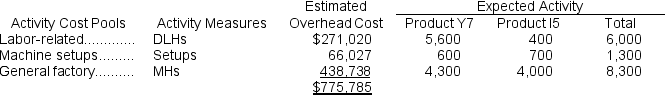

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Determine the unit product cost of each product under the company's traditional costing method.

b.Determine the unit product cost of each product under the activity-based costing method.

Activity-Based Costing

An accounting method that assigns costs to products and services based on the activities required to produce them.

Direct Labor-Hours

The total hours of labor directly involved in manufacturing products or providing services.

Direct Materials Cost

The cost of raw materials and components that are directly traceable to the finished product.

- Analyze and compare unit costs by employing traditional and activity-based costing.

- Allocate overhead expenses based on direct labor hours employing established costing methodologies.

- Assess the distinctions in overhead apportionment between traditional costing systems and Activity-Based Costing.

Verified Answer

AC

arlene calcenaJun 26, 2024

Final Answer :

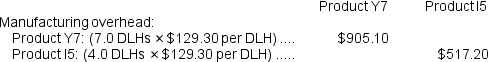

a.Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $775,785 ÷ 6,000 DLHs = $129.30 per DLH (rounded)

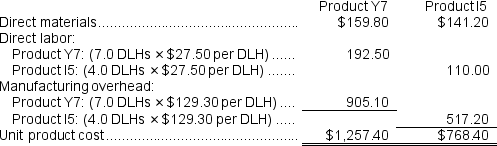

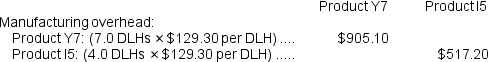

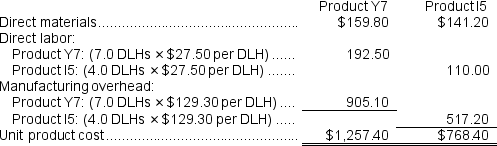

Computation of overhead applied to each product: Computation of traditional unit product costs:

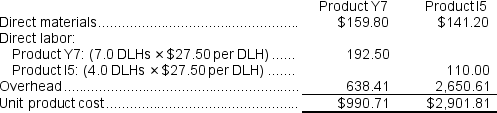

Computation of traditional unit product costs:  b.Computation of activity rates:

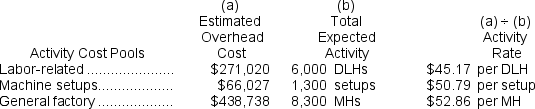

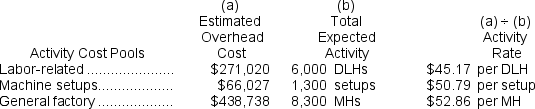

b.Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

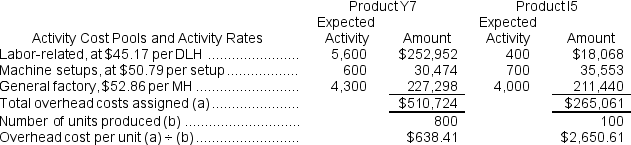

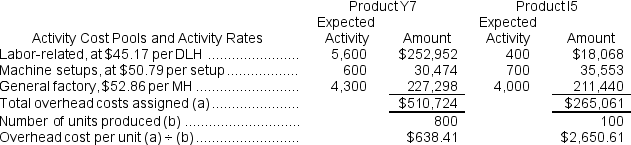

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

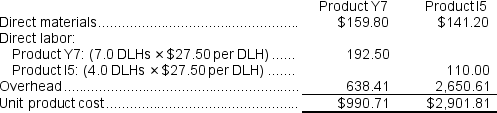

Computation of unit product costs under activity-based costing.

= $775,785 ÷ 6,000 DLHs = $129.30 per DLH (rounded)

Computation of overhead applied to each product:

Computation of traditional unit product costs:

Computation of traditional unit product costs:  b.Computation of activity rates:

b.Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

Computation of unit product costs under activity-based costing.

Learning Objectives

- Analyze and compare unit costs by employing traditional and activity-based costing.

- Allocate overhead expenses based on direct labor hours employing established costing methodologies.

- Assess the distinctions in overhead apportionment between traditional costing systems and Activity-Based Costing.