Asked by Jennifer Guillen on Jun 13, 2024

Verified

The Oberon Company purchased a delivery truck for $95,000 on January 2.The truck was estimated to have a $3,000 salvage value and a 4 year life.The truck was depreciated using the straight-line method.At the beginning of the third year,it was determined the truck's total useful life would be 6 years rather than 4,and the salvage at the end of the 6th year would be $1,500.Determine the depreciation expense for the truck for the 6 years of its life.

Straight-Line Method

The straight-line method is a technique of allocating an asset's cost evenly throughout its useful life, commonly used for depreciation and amortization calculations.

Salvage Value

The approximated market price of an asset upon completing its useful life.

Depreciation Expense

The allocated portion of the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence.

- Comprehend and compute the depreciation expense employing various methodologies including straight-line, double-declining balance, and units-of-production.

- Comprehend the effects of alterations in depreciation estimates and the method for accounting for these changes.

Verified Answer

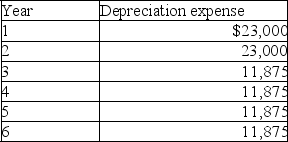

Calculations:

Calculations:Year 1-Year 2 depreciation = ($95,000 - $3,000)/4 years = $23,000

Book value at 12/31/Year 2 = $95,000 - ($23,000 x 2)= $49,000

Year 3-Year 6 depreciation = ($49,000 - $1,500)/4 years = $11,875

Learning Objectives

- Comprehend and compute the depreciation expense employing various methodologies including straight-line, double-declining balance, and units-of-production.

- Comprehend the effects of alterations in depreciation estimates and the method for accounting for these changes.

Related questions

A Company Purchased a Delivery Van on October 1 of ...

On September 30 of the Current Year,a Company Acquired and ...

A Company's Property Records Revealed the Following Information About One ...

Explain the Impact,if Any,on Depreciation When Estimates That Determine Depreciation ...

A Company's Property Records Revealed the Following Information About One ...