Asked by Chantal Paine on Jun 17, 2024

Verified

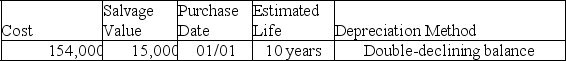

A company's property records revealed the following information about one of its plant assets:

Calculate the depreciation expense in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense in Year 1 and Year 2 for the year ended December 31.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life as an expense, reflecting wear and tear or obsolescence.

Plant Assets

Long-term tangible assets used in the operation of a business, not expected to be converted into cash within a year, such as buildings and machinery.

Year Ended

Refers to the conclusion of a 12-month accounting period, marking the end of a company's financial year.

- Master the calculation of depreciation costs through different strategies, encompassing straight-line, double-declining balance, and units-of-production.

Verified Answer

Year 2: ($154,000 - $30,800)* 20% = $24,640

* DDB depreciation rate = 1/10 * 2 = 20%

Learning Objectives

- Master the calculation of depreciation costs through different strategies, encompassing straight-line, double-declining balance, and units-of-production.

Related questions

Explain the Purpose of and Method of Depreciation for Partial ...

The Oberon Company Purchased a Delivery Truck for $95,000 on ...

Explain in Detail How to Compute Each of the Following ...

On September 30 of the Current Year,a Company Acquired and ...

A Company's Property Records Revealed the Following Information About Its ...