Asked by Takerrah Young on May 16, 2024

Verified

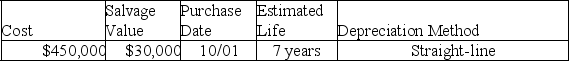

A company's property records revealed the following information about one of its plant assets:

Calculate the depreciation expense for the asset in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense for the asset in Year 1 and Year 2 for the year ended December 31.

Depreciation Expense

A charge that reflects the cost of using fixed assets over their useful life.

Plant Assets

Durable assets with physical form, employed in running a company and not meant for resale.

Year Ended

The conclusion of a 12-month accounting period, at which financial statements are prepared.

- Gain proficiency in determining the depreciation expense utilizing several approaches such as straight-line, double-declining balance, and units-of-production.

Verified Answer

CR

Carlos R Zarate AparicioMay 16, 2024

Final Answer :

Year 1 [($450,000 - $30,000)/7] *3/12 = $15,000

Year 2 ($450,000 - $30,000)/7 = $60,000

Year 2 ($450,000 - $30,000)/7 = $60,000

Learning Objectives

- Gain proficiency in determining the depreciation expense utilizing several approaches such as straight-line, double-declining balance, and units-of-production.

Related questions

On September 30 of the Current Year,a Company Acquired and ...

Explain the Purpose of and Method of Depreciation for Partial ...

The Oberon Company Purchased a Delivery Truck for $95,000 on ...

A Company Purchased a Delivery Van on October 1 of ...

A Company's Property Records Revealed the Following Information About One ...