Asked by Charlotte Laprarie on Jun 20, 2024

Verified

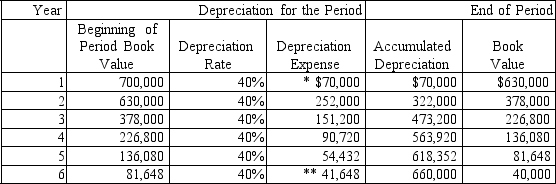

On September 30 of the current year,a company acquired and placed in service a machine at a cost of $700,000.It has been estimated that the machine has a service life of five years and a salvage value of $40,000.Using the double-declining-balance method of depreciation,complete the schedule below showing depreciation amounts for all six years (round answers to the nearest dollar).The company closes its books on December 31 of each year.

Double-Declining-Balance

A method of accelerated depreciation which doubles the rate at which an asset's book value depreciates compared to straight-line depreciation.

Salvage Value

The estimation of an asset's value at the end of its period of utility.

Depreciation

The systematic allocation of the cost of a tangible asset over its useful life, representing the wear and tear or obsolescence of the asset.

- Understand and ascertain the depreciation expense by employing multiple methodologies including straight-line, double-declining balance, and units-of-production.

Verified Answer

*for 3 months.

*for 3 months.**for 9 months; adjusted to the salvage value.

Learning Objectives

- Understand and ascertain the depreciation expense by employing multiple methodologies including straight-line, double-declining balance, and units-of-production.

Related questions

Explain the Purpose of and Method of Depreciation for Partial ...

The Oberon Company Purchased a Delivery Truck for $95,000 on ...

Explain in Detail How to Compute Each of the Following ...

A Company's Property Records Revealed the Following Information About Its ...

A Company's Property Records Revealed the Following Information About One ...