Asked by Camri Baldwin on Jul 24, 2024

Verified

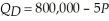

The market demand and supply functions for imported cars are:  and

and  The legislature is considering a tariff (a tax on imported goods) equal to $2,000 per unit to aid domestic car manufacturers. If the tariff is implemented, calculate the loss in producer surplus. How many units of cars are imported? Suppose that instead of a tariff, importers agree to voluntarily restrict their imports to this level. If they do and no tariff is implemented, calculate producer surplus in this scenario. Do you expect importers will be more in favor of a tariff or a voluntary quota?

The legislature is considering a tariff (a tax on imported goods) equal to $2,000 per unit to aid domestic car manufacturers. If the tariff is implemented, calculate the loss in producer surplus. How many units of cars are imported? Suppose that instead of a tariff, importers agree to voluntarily restrict their imports to this level. If they do and no tariff is implemented, calculate producer surplus in this scenario. Do you expect importers will be more in favor of a tariff or a voluntary quota?

Tariff

A tax imposed by a government on goods and services imported from other countries, affecting trade.

Voluntary Quota

A self-imposed limit on the quantity of goods a country exports or imports.

- Quantify the influence of taxation and subsidies on the economic well-being of consumers and producers.

- Study the impact of designated taxes and subsidies on the balance of the market through an economic lens.

Verified Answer

PJ

Pricilla JosephinJul 25, 2024

Final Answer :

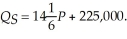

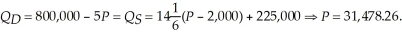

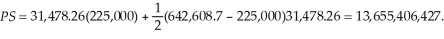

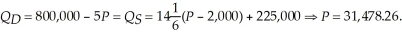

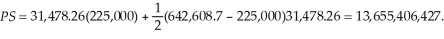

First we must determine the market equilibrium quantity and price with the tariff. To do this, we set quantity demanded equal to quantity supplied and solve for the price consumers pay.  At a price of $31,478.26, the quantity imported will be: 642,608.7. Producer surplus is

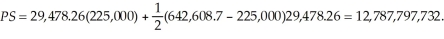

At a price of $31,478.26, the quantity imported will be: 642,608.7. Producer surplus is  If no tariff is implemented, but importers restrict quantity to 642,608.7 units, consumers will pay $31,478.26 per unit. Now importers receive the full amount of the price consumers pay as there is no tariff. This means that with a voluntary quota, producer surplus must be higher than with a tariff. This is shown as follows. New producer surplus with the voluntary quota is:

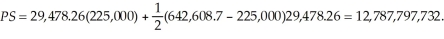

If no tariff is implemented, but importers restrict quantity to 642,608.7 units, consumers will pay $31,478.26 per unit. Now importers receive the full amount of the price consumers pay as there is no tariff. This means that with a voluntary quota, producer surplus must be higher than with a tariff. This is shown as follows. New producer surplus with the voluntary quota is:

At a price of $31,478.26, the quantity imported will be: 642,608.7. Producer surplus is

At a price of $31,478.26, the quantity imported will be: 642,608.7. Producer surplus is  If no tariff is implemented, but importers restrict quantity to 642,608.7 units, consumers will pay $31,478.26 per unit. Now importers receive the full amount of the price consumers pay as there is no tariff. This means that with a voluntary quota, producer surplus must be higher than with a tariff. This is shown as follows. New producer surplus with the voluntary quota is:

If no tariff is implemented, but importers restrict quantity to 642,608.7 units, consumers will pay $31,478.26 per unit. Now importers receive the full amount of the price consumers pay as there is no tariff. This means that with a voluntary quota, producer surplus must be higher than with a tariff. This is shown as follows. New producer surplus with the voluntary quota is:

Learning Objectives

- Quantify the influence of taxation and subsidies on the economic well-being of consumers and producers.

- Study the impact of designated taxes and subsidies on the balance of the market through an economic lens.