Asked by Dalton Regier on Jul 13, 2024

Verified

The market demand and supply functions for Easton Redline slow-pitch softball bats are:  and

and  Calculate the equilibrium quantity and price and point elasticity of demand in equilibrium. Next, calculate consumer surplus. Suppose the Easton bats are taxed $25 per unit. Calculate the revenues generated by the tax. Calculate the loss in consumer surplus. What percentage of the burden of the tax is paid for by consumers?

Calculate the equilibrium quantity and price and point elasticity of demand in equilibrium. Next, calculate consumer surplus. Suppose the Easton bats are taxed $25 per unit. Calculate the revenues generated by the tax. Calculate the loss in consumer surplus. What percentage of the burden of the tax is paid for by consumers?

Consumer Surplus

The difference between the total amount that consumers are willing and able to pay for a good or service and the total amount they actually do pay.

Easton Bats

A brand known for manufacturing sports equipment, particularly high-quality baseball and softball bats.

Burden of the Tax

The distribution of the financial impact of a tax between buyers and sellers in a market.

- Analyze the consequences of implementing taxes and subsidies on the surplus of consumers and producers.

- Assess the economic repercussions of distinct taxes and subsidies on market stability.

Verified Answer

IC

Iyanna ClarkeJul 17, 2024

Final Answer :

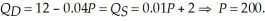

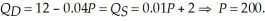

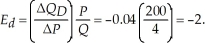

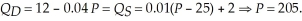

First we must determine the market equilibrium quantity and price. To do this, we set quantity demanded equal to quantity supplied and solve for equilibrium price.  At a price of $200, the quantity exchanged will be 4. The point elasticity of demand is

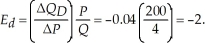

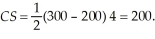

At a price of $200, the quantity exchanged will be 4. The point elasticity of demand is  The choke price (lowest price such that no units are transacted) is $300. The consumer surplus is

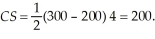

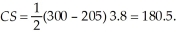

The choke price (lowest price such that no units are transacted) is $300. The consumer surplus is  If the bat market is taxed $25 per unit, the equilibrium price consumers pay is:

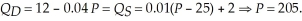

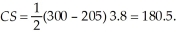

If the bat market is taxed $25 per unit, the equilibrium price consumers pay is:  The quantity exchanged is 3.8. The new level of consumer surplus is:

The quantity exchanged is 3.8. The new level of consumer surplus is:  The loss in consumer surplus associated with the tax is $19.50. The tax generates tax revenues of $95. Consumers pay $5 more per unit. Thus, consumers bear 20% of the burden of the tax.

The loss in consumer surplus associated with the tax is $19.50. The tax generates tax revenues of $95. Consumers pay $5 more per unit. Thus, consumers bear 20% of the burden of the tax.

At a price of $200, the quantity exchanged will be 4. The point elasticity of demand is

At a price of $200, the quantity exchanged will be 4. The point elasticity of demand is  The choke price (lowest price such that no units are transacted) is $300. The consumer surplus is

The choke price (lowest price such that no units are transacted) is $300. The consumer surplus is  If the bat market is taxed $25 per unit, the equilibrium price consumers pay is:

If the bat market is taxed $25 per unit, the equilibrium price consumers pay is:  The quantity exchanged is 3.8. The new level of consumer surplus is:

The quantity exchanged is 3.8. The new level of consumer surplus is:  The loss in consumer surplus associated with the tax is $19.50. The tax generates tax revenues of $95. Consumers pay $5 more per unit. Thus, consumers bear 20% of the burden of the tax.

The loss in consumer surplus associated with the tax is $19.50. The tax generates tax revenues of $95. Consumers pay $5 more per unit. Thus, consumers bear 20% of the burden of the tax.

Learning Objectives

- Analyze the consequences of implementing taxes and subsidies on the surplus of consumers and producers.

- Assess the economic repercussions of distinct taxes and subsidies on market stability.