Asked by Willis Sands on Jul 16, 2024

Verified

The market demand and supply functions for pizza are:  and

and  Calculate the consumer and producer surplus. Suppose the local community charges a $1 per pizza tax. Calculate the new levels of consumer and producer surplus. Does the gain in tax revenue offset the losses in consumer and producer surplus associated with the tax?

Calculate the consumer and producer surplus. Suppose the local community charges a $1 per pizza tax. Calculate the new levels of consumer and producer surplus. Does the gain in tax revenue offset the losses in consumer and producer surplus associated with the tax?

Consumer Surplus

The contrast between what consumers intend to pay for an item or service and the real cost they bear.

Producer Surplus

The gap between the price producers are prepared to take for a product and the price they end up getting.

Pizza Tax

A hypothetical or symbolic tax imposed on unhealthy food products to discourage consumption and address public health concerns.

- Compute the repercussions of taxes and subsidies on the surplus received by consumers and manufacturers.

- Analyze the impact of tax and subsidy measures on economic effectiveness and equity.

- Examine policy options for correcting market externalities and their implications for social welfare.

Verified Answer

PP

Primrose PanesarJul 21, 2024

Final Answer :

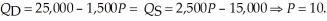

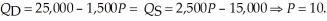

First we must determine the market equilibrium quantity and price. To do this, we set quantity demanded equal to quantity supplied and solve for equilibrium price.  At a price of $10, the quantity exchanged will be: 10,000. The choke price (lowest price such that no units are transacted) is $16

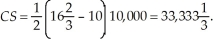

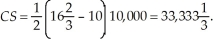

At a price of $10, the quantity exchanged will be: 10,000. The choke price (lowest price such that no units are transacted) is $16  . The highest price such that no pizzas will be produced is $6. Consumer surplus is

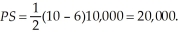

. The highest price such that no pizzas will be produced is $6. Consumer surplus is  Producer surplus is

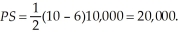

Producer surplus is  Welfare in the market is $53,333

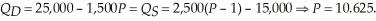

Welfare in the market is $53,333  . If a tax of $1 per unit is implemented, we need to determine the new equilibrium quantity and price consumers pay.

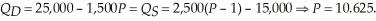

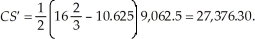

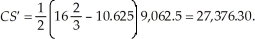

. If a tax of $1 per unit is implemented, we need to determine the new equilibrium quantity and price consumers pay.  At this price, consumers purchase 9,062.5 units. Consumer surplus is

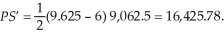

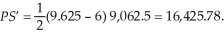

At this price, consumers purchase 9,062.5 units. Consumer surplus is  Producer surplus is

Producer surplus is  Government tax revenues are $9,062.50. The new level of welfare is $52,864.58. The increase in government tax receipts does not offset the loss in consumer and producer surplus and welfare has gone down in the market because of the tax.

Government tax revenues are $9,062.50. The new level of welfare is $52,864.58. The increase in government tax receipts does not offset the loss in consumer and producer surplus and welfare has gone down in the market because of the tax.

At a price of $10, the quantity exchanged will be: 10,000. The choke price (lowest price such that no units are transacted) is $16

At a price of $10, the quantity exchanged will be: 10,000. The choke price (lowest price such that no units are transacted) is $16  . The highest price such that no pizzas will be produced is $6. Consumer surplus is

. The highest price such that no pizzas will be produced is $6. Consumer surplus is  Producer surplus is

Producer surplus is  Welfare in the market is $53,333

Welfare in the market is $53,333  . If a tax of $1 per unit is implemented, we need to determine the new equilibrium quantity and price consumers pay.

. If a tax of $1 per unit is implemented, we need to determine the new equilibrium quantity and price consumers pay.  At this price, consumers purchase 9,062.5 units. Consumer surplus is

At this price, consumers purchase 9,062.5 units. Consumer surplus is  Producer surplus is

Producer surplus is  Government tax revenues are $9,062.50. The new level of welfare is $52,864.58. The increase in government tax receipts does not offset the loss in consumer and producer surplus and welfare has gone down in the market because of the tax.

Government tax revenues are $9,062.50. The new level of welfare is $52,864.58. The increase in government tax receipts does not offset the loss in consumer and producer surplus and welfare has gone down in the market because of the tax.

Learning Objectives

- Compute the repercussions of taxes and subsidies on the surplus received by consumers and manufacturers.

- Analyze the impact of tax and subsidy measures on economic effectiveness and equity.

- Examine policy options for correcting market externalities and their implications for social welfare.