Asked by eunice morel on Jul 22, 2024

Verified

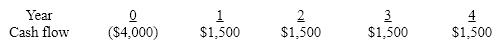

The future cash flows of a stand-alone capital project are:  If the firm's cost of capital is 12%, which of the following statements is true?

If the firm's cost of capital is 12%, which of the following statements is true?

A) The NPV is > $0 and the IRR is less than 12.5%.

B) The NPV is.

C) The NPV is > $0 and the IRR is approximately 18.5%.

D) The NPV is

Cost of Capital

The minimum profit percentage a corporation is required to generate from its investment initiatives to keep its market price stable and draw in financing.

Cash Flows

The total amount of money being transferred in and out of a business, especially affecting liquidity.

IRR

The Internal Rate of Return; a financial metric used to estimate the profitability of potential investments.

- Compute and elucidate the Net Present Value (NPV) across different initiatives.

- Perform calculations to identify and clarify the IRR for assorted investment ventures.

Verified Answer

ET

Elias TwerskyJul 28, 2024

Final Answer :

C

Explanation :

To calculate the NPV, we discount each cash flow using the cost of capital of 12% and sum them up. The NPV is positive when the present value of cash inflows is greater than the present value of cash outflows. In this case, the NPV is positive at a discount rate of 12%, indicating that the project has value for the firm.

To determine the internal rate of return (IRR), we calculate the discount rate that makes the NPV equal to zero. Using the cash flows provided, we find that the IRR is approximately 18.5%.

Therefore, statement C is true, as the NPV is > $0 and the IRR is approximately 18.5%.

To determine the internal rate of return (IRR), we calculate the discount rate that makes the NPV equal to zero. Using the cash flows provided, we find that the IRR is approximately 18.5%.

Therefore, statement C is true, as the NPV is > $0 and the IRR is approximately 18.5%.

Learning Objectives

- Compute and elucidate the Net Present Value (NPV) across different initiatives.

- Perform calculations to identify and clarify the IRR for assorted investment ventures.