Asked by Mitchel Rozwadowski on May 05, 2024

Verified

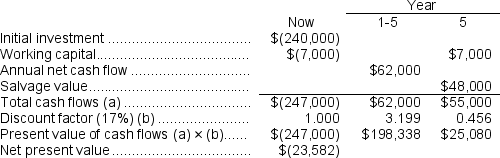

(Ignore income taxes in this problem.)Joanette, Inc., is considering the purchase of a machine that would cost $240,000 and would last for 5 years, at the end of which, the machine would have a salvage value of $48,000.The machine would reduce labor and other costs by $62,000 per year.Additional working capital of $7,000 would be needed immediately, all of which would be recovered at the end of 5 years.The company requires a minimum pretax return of 17% on all investment projects.

Required:

Determine the net present value of the project.Show your work!

Salvage Value

The estimated residual value of an asset at the end of its useful life, which can be recovered through disposal or sale.

Pretax Return

Pretax Return refers to the earnings of a company before the deduction of taxes, often used to analyze profitability from core operations.

Net Present Value

A method used in capital budgeting to assess the profitability of an investment, calculating the difference between the present value of cash inflows and outflows.

- Comprehend the methodology to compute the net present value (NPV) for various initiatives.

- Comprehend the factors influencing investment decision-making excluding income tax considerations.

Verified Answer

BV

Learning Objectives

- Comprehend the methodology to compute the net present value (NPV) for various initiatives.

- Comprehend the factors influencing investment decision-making excluding income tax considerations.