Asked by Vincent Zhang on May 14, 2024

Verified

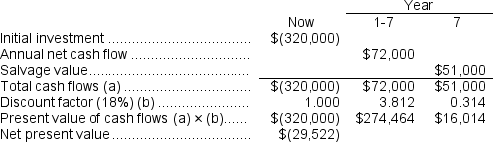

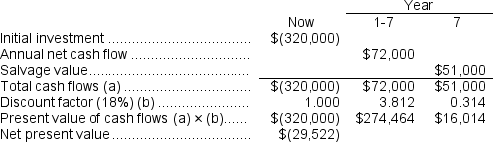

The net present value of the proposed project is closest to:

A) $(29,522)

B) $(45,536)

C) $5,464

D) $(94,042)

Proposed Project

An outlined plan or proposal for a future project, often including objectives, methodologies, and potential impacts.

Net Present Value

The disparity between the current value of cash coming in and the current value of cash going out over a time frame, utilized in capital budgeting to evaluate an investment's profitability.

- Acquire knowledge on the calculation of net present value (NPV) for a range of projects.

Verified Answer

NW

Nyquan WilsonMay 15, 2024

Final Answer :

A

Explanation :  Reference: CH12-Ref14

Reference: CH12-Ref14

(Ignore income taxes in this problem.)Treads Corporation is considering the purchase of a new machine to replace an old machine that is currently being used.The old machine is fully depreciated but can be used by the corporation for five more years.If Treads decides to buy the new machine, the old machine can be sold for $60,000.The old machine would have no salvage value in five years.

The new machine would be purchased for $1,000,000 in cash.The new machine has an expected useful life of five years with no salvage value.Due to the increased efficiency of the new machine, the company would benefit from annual cash savings of $300,000.

Treads Corporation uses a discount rate of 12%.

Reference: CH12-Ref14

Reference: CH12-Ref14(Ignore income taxes in this problem.)Treads Corporation is considering the purchase of a new machine to replace an old machine that is currently being used.The old machine is fully depreciated but can be used by the corporation for five more years.If Treads decides to buy the new machine, the old machine can be sold for $60,000.The old machine would have no salvage value in five years.

The new machine would be purchased for $1,000,000 in cash.The new machine has an expected useful life of five years with no salvage value.Due to the increased efficiency of the new machine, the company would benefit from annual cash savings of $300,000.

Treads Corporation uses a discount rate of 12%.

Learning Objectives

- Acquire knowledge on the calculation of net present value (NPV) for a range of projects.