Asked by Waseem Nazir on Apr 30, 2024

Verified

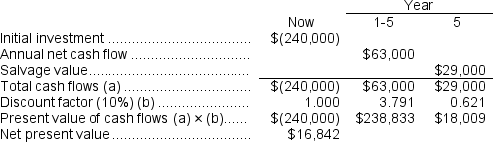

(Ignore income taxes in this problem.)Wary Corporation is considering the purchase of a machine that would cost $240,000 and would last for 9 years.At the end of 5 years, the machine would have a salvage value of $29,000.The machine would reduce labor and other costs by $63,000 per year.The company requires a minimum pretax return of 10% on all investment projects.

Required:

Determine the net present value of the project.Show your work!

Salvage Value

The anticipated sale price of an asset at the conclusion of its operational lifespan.

Pretax Return

Income earned by a business before deductions for income taxes, serving as a measure of its profitability.

Investment Projects

Initiatives or plans undertaken by an organization or individual involving the allocation of resources with the expectation of generating future returns.

- Master the techniques of calculating the net present value (NPV) of assorted projects.

- Acquire knowledge of the elements essential in determining investment choices, disregarding income tax implications.

Verified Answer

ZK

Learning Objectives

- Master the techniques of calculating the net present value (NPV) of assorted projects.

- Acquire knowledge of the elements essential in determining investment choices, disregarding income tax implications.