Asked by Ashley Elizabeth on May 02, 2024

Verified

The following series of transactions occurred during Year 1 and Year 2,when Foxworth Co.sold merchandise to Kevin Lewis.Foxworth's annual accounting period ends on December 31.

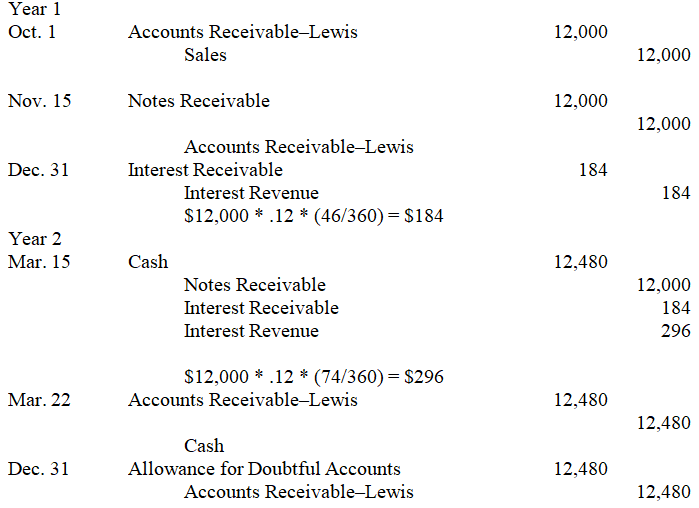

10/01/Yr 1 Sold $12,000 of merchandise to K.Lewis,terms n/30.

11/15/Yr 1 Lewis reports that he cannot pay the account until early next year.He agrees to exchange the account for a 120-day,12% note receivable.

12/31/Yr 1 Prepared the adjusting journal entry to record accrued interest on the note.

03/15/Yr 2 Foxworth receives a check from Lewis for the maturity value (with interest)of the note.

03/22/Yr 2 Foxworth receives notification that Lewis' check is being returned for nonsufficient funds (NSF).

12/31/Yr 2 Foxworth writes off Lewis' account as uncollectible.

Prepare Foxworth Co.'s journal entries to record the above transactions.The company uses the allowance method to account for its bad debt expense.

Allowance Method

An accounting technique used to estimate the amount of bad debts that will not be collected from customers.

Note Receivable

A financial asset representing a promise to receive a specific amount of money at one or more future dates, typically a formal loan to another entity.

Uncollectible Account

A receivable that a company has deemed to be uncollectable from the debtor, often written off as bad debt or expense.

- Become versed in the principles and techniques applied in accounting for uncollectible accounts.

- Attain competence in generating journal entries for transactions associated with bad debts and note receivables.

- Understand the procedures and accounting treatment for notes receivable, including interest calculation, maturity dates, and dishonored notes.

Verified Answer

Learning Objectives

- Become versed in the principles and techniques applied in accounting for uncollectible accounts.

- Attain competence in generating journal entries for transactions associated with bad debts and note receivables.

- Understand the procedures and accounting treatment for notes receivable, including interest calculation, maturity dates, and dishonored notes.

Related questions

A Company Has the Following Unadjusted Account Balances at December ...

On May 31,Cray Has $375,800 of Accounts Receivable ...

When the Maker of a Note Is Unable or Refuses ...

Prepare General Journal Entries for the Following Transactions of Norman ...

On July 31,Orwell Co.has $448,800 of Accounts Receivable ...