Asked by Johnna-Bryante Rayphen on Jul 29, 2024

Verified

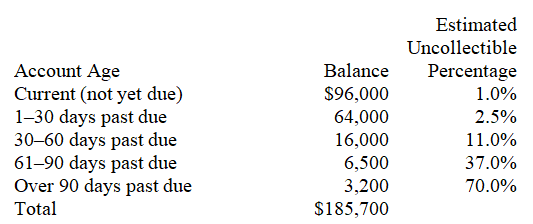

A company has the following unadjusted account balances at December 31,of the current year; Accounts Receivable of $185,700 and Allowance for Doubtful Accounts of $1,600 (credit balance).The company uses the aging of accounts receivable to estimate its bad debts.The following aging schedule reflects its accounts receivable at the current year-end:

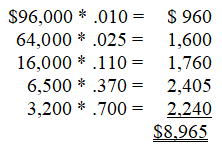

1.Calculate the amount of the Allowance for Doubtful Accounts that should appear on the December 31,of the current year,balance sheet.

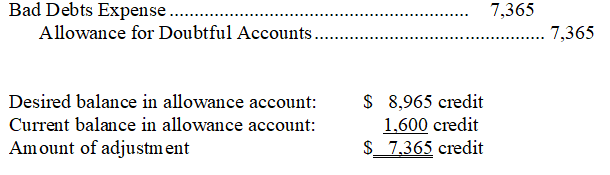

2.Prepare the adjusting journal entry to record bad debts expense for the current year.

Aging of Accounts Receivable

A method used to categorize accounts receivable based on the length of time an invoice has been outstanding, to manage and collect debts effectively.

Allowance for Doubtful Accounts

A contra-asset account used to estimate the amount of receivables that may not be collected.

Bad Debts Expense

An expense account reflecting the cost of accounts receivable that a company does not expect to collect, typically due to customers' inability to pay.

- Develop an understanding of the principles and workflow in accounting for accounts receivable that cannot be collected.

- Familiarize oneself with the approaches to assess bad debts expense, namely through the allowance method and the direct write-off method.

- Acquire knowledge on how to apply aged receivables in forecasting the allowance for doubtful accounts.

Verified Answer

Learning Objectives

- Develop an understanding of the principles and workflow in accounting for accounts receivable that cannot be collected.

- Familiarize oneself with the approaches to assess bad debts expense, namely through the allowance method and the direct write-off method.

- Acquire knowledge on how to apply aged receivables in forecasting the allowance for doubtful accounts.

Related questions

Owens Company Uses the Direct Write-Off Method of Accounting for ...

The ________ Method Uses Both Past and Current Receivables to ...

Thatcher Company Had a January 1,credit Balance in Its Allowance ...

At December 31 of the Current Year,a Company Reported the ...

On May 31,Cray Has $375,800 of Accounts Receivable ...