Asked by Carlos Iturralde on Jul 05, 2024

Verified

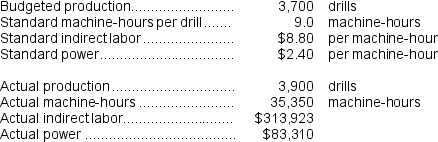

The following data for November have been provided by Hunn Corporation, a producer of precision drills for oil exploration:  Required:

Required:

Compute the variable overhead rate variances for indirect labor and for power for November.Indicate whether each of the variances is favorable (F)or unfavorable (U).Show your work!

Variable Overhead Rate Variances

The difference between the actual variable overhead incurred and the standard cost allocated, based on actual production activity.

Indirect Labor

Costs associated with employees who are not directly involved in the production of goods or services, such as maintenance and clerical staff.

Precision Drills

Specialized tools or equipment designed for creating holes with exact dimensions and tolerances.

- Familiarize and execute applications involving rate and efficiency variances of variable overhead.

Verified Answer

OM

Olivia mualimJul 08, 2024

Final Answer :

Indirect labor:

Variable overhead rate variance = (AH × AR)− (AH × SR)

= $313,923 − (35,350 hours × $8.80 per hour)

= $313,923 − $311,080

= $2,843 U

Power:

Variable overhead rate variance = (AH × AR)− (AH × SR)

= $83,310 − (35,350 hours × $2.40 per hour)

= $83,310 − $84,840

= $1,530 F

Variable overhead rate variance = (AH × AR)− (AH × SR)

= $313,923 − (35,350 hours × $8.80 per hour)

= $313,923 − $311,080

= $2,843 U

Power:

Variable overhead rate variance = (AH × AR)− (AH × SR)

= $83,310 − (35,350 hours × $2.40 per hour)

= $83,310 − $84,840

= $1,530 F

Learning Objectives

- Familiarize and execute applications involving rate and efficiency variances of variable overhead.