Asked by seydi ortiz on Jun 11, 2024

Verified

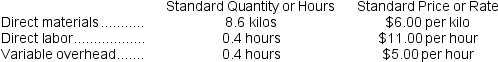

Sakelaris Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in August.

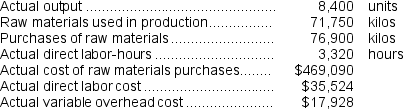

The company reported the following results concerning this product in August.  The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

Required:

a.Compute the materials quantity variance.

b.Compute the materials price variance.

c.Compute the labor efficiency variance.

d.Compute the labor rate variance.

e.Compute the variable overhead efficiency variance.

f.Compute the variable overhead rate variance.

Materials Quantity Variance

The discrepancy between the actual use of materials in production and the planned use, each multiplied by the predetermined cost per unit.

Variable Overhead

Indirect manufacturing costs that vary with the level of production activity, such as utilities for the manufacturing plant.

Direct Labor-hours

The total hours worked by employees directly involved in manufacturing a product, often used as a basis for allocating labor costs to products.

- Quantify the deviations in material costs and the variations in amounts of materials.

- Calculate labor rate variances and labor efficiency variances.

- Understand and apply variable overhead efficiency and rate variances.

Verified Answer

Materials quantity variance = (AQ - SQ)× SP

= (71,750 kilos − 72,240 kilos)× $6.00 per kilo

= (-490 kilos)× $6.00 per kilo

= $2,940 F

b.Materials price variance = (AQ × AP)− (AQ × SP)

= ($469,090)− (76,900 kilos × $6.00 per kilo)

= $469,090 − $461,400

= $7,690 U

c.SH = 8,400 units × 0.4 hours per unit = 3,360 hours

Labor efficiency variance = (AH - SH)× SR

= (3,320 hours − 3,360 hours)× $11.00 per hour

= (−40 hours)× $11.00 per hour

= $440 F

d.Labor rate variance = (AH × AR)− (AH × SR)

= ($35,524)− (3,320 hours × $11.00 per hour)

= $35,524 − $36,520

= $996 F

e.SH = 8,400 units × 0.4 hours per unit = 3,360 hours

Variable overhead efficiency variance = (AH - SH)× SR

= (3,320 hours − 3,360 hours)× $5.00 per hour

= (−40 hours)× $5.00 per hour

= $200 F

f.Variable overhead rate variance = (AH × AR)− (AH × SR)

= ($17,928)− (3,320 hours × $5.00 per hour)

= $17,928 − $16,600

= $1,328 U

Learning Objectives

- Quantify the deviations in material costs and the variations in amounts of materials.

- Calculate labor rate variances and labor efficiency variances.

- Understand and apply variable overhead efficiency and rate variances.

Related questions

The Standards for Product G78V Specify 4 ...

The Following Data for November Have Been Provided by Hunn ...

The Following Direct Labor Standards Have Been Established for Product ...

The Following Materials Standards Have Been Established for a Particular ...

The Following Information Comes from the Records of Barney Co ...