Asked by Brooke Rupert on Jun 11, 2024

Verified

The variable overhead rate variance for August is:

A) $640 F

B) $580 U

C) $640 U

D) $580 F

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the standard variable overhead estimated.

- Familiarize oneself with the theoretical and calculative processes pertaining to variable overhead rate and efficiency variances.

Verified Answer

VN

Vuyisile NgwenyaJun 12, 2024

Final Answer :

B

Explanation :

Variable overhead rate variance = (Actual variable overhead rate - Budgeted variable overhead rate) x Actual hours worked

= ($7.20 - $6.60) x 9,000 hours

= $5,400 U

Since the actual variable overhead rate is higher than the budgeted rate, the variance is unfavorable, which means it is an unfavorable variance or an adverse variance. Therefore, the answer is B, which indicates an unfavorable variance of $580.

= ($7.20 - $6.60) x 9,000 hours

= $5,400 U

Since the actual variable overhead rate is higher than the budgeted rate, the variance is unfavorable, which means it is an unfavorable variance or an adverse variance. Therefore, the answer is B, which indicates an unfavorable variance of $580.

Explanation :

Variable overhead rate variance = (AH × AR)? (AH × SR)

= ($7,540)? (1,160 hours × $6.00 per hour)

= $7,540 ? $6,960

= $580 U

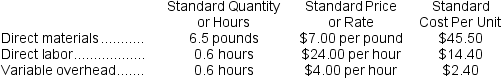

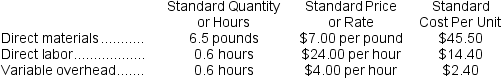

Reference: CH09-Ref48

Kartman Corporation makes a product with the following standard costs: In June the company's budgeted production was 3,400 units but the actual production was 3,500 units.The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output.During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180.The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units.The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output.During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180.The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

= ($7,540)? (1,160 hours × $6.00 per hour)

= $7,540 ? $6,960

= $580 U

Reference: CH09-Ref48

Kartman Corporation makes a product with the following standard costs:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units.The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output.During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180.The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units.The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output.During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180.The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

Learning Objectives

- Familiarize oneself with the theoretical and calculative processes pertaining to variable overhead rate and efficiency variances.