Asked by Yassine Wydadi on Apr 28, 2024

Verified

The company's equity multiplier at the end of Year 2 is closest to:

A) 0.28

B) 1.28

C) 3.53

D) 0.78

Equity Multiplier

A financial ratio that measures a company's leverage, calculated as total assets divided by total equity.

Year 2

The second year in a given time frame or series, often referring to fiscal or calendar years.

- Analyze the equity multiplier to gain insight into the extent of financial leverage.

Verified Answer

KR

Kaylin RicciMay 03, 2024

Final Answer :

B

Explanation :

Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,652,500 ÷ $1,292,500 = 1.28 (rounded)

*Average total assets = ($1,675,000 + $1,630,000)÷ 2 = $1,652,500

**Average stockholders' equity = ($1,305,000 + $1,280,000)÷ 2 = $1,292,500

Reference: CH14-Ref13

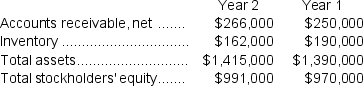

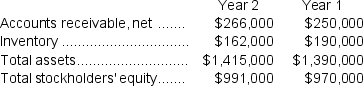

Burdick Corporation has provided the following financial data from its balance sheet: Sales (all on account)in Year 2 amounted to $1,410,000 and the cost of goods sold was $860,000.

Sales (all on account)in Year 2 amounted to $1,410,000 and the cost of goods sold was $860,000.

= $1,652,500 ÷ $1,292,500 = 1.28 (rounded)

*Average total assets = ($1,675,000 + $1,630,000)÷ 2 = $1,652,500

**Average stockholders' equity = ($1,305,000 + $1,280,000)÷ 2 = $1,292,500

Reference: CH14-Ref13

Burdick Corporation has provided the following financial data from its balance sheet:

Sales (all on account)in Year 2 amounted to $1,410,000 and the cost of goods sold was $860,000.

Sales (all on account)in Year 2 amounted to $1,410,000 and the cost of goods sold was $860,000.

Learning Objectives

- Analyze the equity multiplier to gain insight into the extent of financial leverage.

Related questions

Remley Corporation Has Provided the Following Financial Data ...

Wittels Corporation Has Provided the Following Data: in Year ...

Mahoe Corporation Has Provided the Following Financial Data: Dividends ...

A Firm Is Worth $1,400, Has a 35% Tax Rate ...

Which of the Following Is True Regarding the Calculation of ...