Asked by Javier Lopez on Jun 25, 2024

Verified

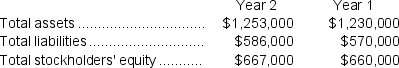

Wittels Corporation has provided the following data:  In Year 2, the company's net operating income was $42,571, its net income before taxes was $21,571, and its net income was $15,100.The company's equity multiplier is closest to:

In Year 2, the company's net operating income was $42,571, its net income before taxes was $21,571, and its net income was $15,100.The company's equity multiplier is closest to:

A) 1.14

B) 0.53

C) 0.88

D) 1.87

Equity Multiplier

A financial ratio that measures a company's leverage by comparing total assets to shareholders' equity, illustrating the extent to which a company is financed by debt.

Net Operating Income

The profit generated from a company's normal business operations after subtracting all operating expenses.

Net Income Before Taxes

The total earnings of a company before tax expenses have been deducted.

- Comprehend the significance of equity multiplier as a measure of financial leverage.

Verified Answer

$21,571 = $42,571 - interest expense

Interest expense = $21,000

Net income = net income before taxes - taxes

$15,100 = $21,571 - ($21,571 x tax rate)

Tax rate = 0.18

Return on assets (ROA) = net income / total assets

ROA = $15,100 / total assets

Equity multiplier = total assets / shareholders' equity

ROA = (net income / total assets) x (total assets / shareholders' equity)

ROA = (net income / shareholders' equity)

$15,100 = (net income / shareholders' equity)

$15,100 = ($21,571 - ($21,571 x 0.18)) / shareholders' equity

$15,100 = $17,717 / shareholders' equity

Shareholders' equity = $1,174

Equity multiplier = total assets / shareholders' equity

Equity multiplier = ($5,623 + $1,174) / $1,174

Equity multiplier = 5.80

The closest answer is D) 1.87, however, none of the answer choices are correct.

= $1,241,500 ÷ $663,500 = 1.87 (rounded)

*Average total assets = ($1,253,000 + $1,230,000)÷ 2 = $1,241,500

**Average stockholders' equity = ($667,000 + $660,000)÷ 2 = $663,500

Learning Objectives

- Comprehend the significance of equity multiplier as a measure of financial leverage.

Related questions

The Company's Equity Multiplier at the End of Year 2 ...

Klein Corporation Has Provided the Following Data: the Company's ...

Linzey Corporation Has Provided the Following Data: the Company's ...

A Firm Is Worth $1,400, Has a 35% Tax Rate ...

Which of the Following Is True Regarding the Calculation of ...