Asked by Riley Runnells on Apr 29, 2024

Verified

The company has received a special, one-time-only order for 400 units of component P06.There would be no variable selling expense on this special order and the total fixed manufacturing overhead and fixed selling and administrative expenses of the company would not be affected by the order.Assuming that Younes has excess capacity and can fill the order without cutting back on the production of any product, what is the minimum price per unit below which the company should not accept the special order?

A) $47 per unit

B) $83 per unit

C) $63 per unit

D) $220 per unit

Variable Selling Expense

Costs associated with selling a product that vary with the volume of sales, such as commissions or shipping costs.

Fixed Manufacturing

Costs associated with manufacturing that do not vary with the level of production output, such as rent for factory premises, salaries of permanent staff, and depreciation of machinery.

Special Order

An order for a product or service that is outside the company's standard offerings, typically requiring unique specifications or quantities.

- Evaluate the financial impact of special orders on company profits.

Verified Answer

YV

Ygnaxio VergaraMay 03, 2024

Final Answer :

A

Explanation :

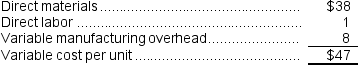

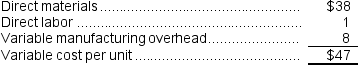

The selling price for the special order would have to at least cover the variable cost per unit of $47.

Learning Objectives

- Evaluate the financial impact of special orders on company profits.