Asked by Victor Bedoya on May 16, 2024

Verified

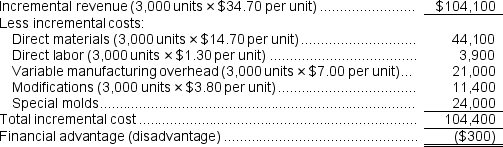

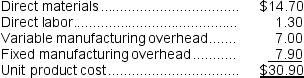

A customer has asked Lalka Corporation to supply 3,000 units of product H60, with some modifications, for $34.70 each.The normal selling price of this product is $46.35 each.The normal unit product cost of product H60 is computed as follows:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product H60 that would increase the variable costs by $3.80 per unit and that would require a one-time investment of $24,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product H60 that would increase the variable costs by $3.80 per unit and that would require a one-time investment of $24,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Required:

Determine the financial advantage or disadvantage of accepting the special order.Show your work!

Special Order

A one-time order or contract that is outside of a company’s normal production or service offerings, often requiring special terms.

Variable Cost

Costs that vary directly with the level of production or volume of output.

Fixed Manufacturing Overhead

Costs associated with manufacturing that do not vary with the level of production, such as rent, salaries of permanent staff, and depreciation of factory equipment.

- Analyze special orders and determine their financial implications.

Verified Answer

AG

Learning Objectives

- Analyze special orders and determine their financial implications.