Asked by Omarie Harrison on May 17, 2024

Verified

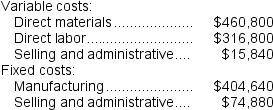

Anglen Co.manufactures and sells trophies for winners of athletic and other events.Its manufacturing plant has the capacity to produce 18,000 trophies each month; current monthly production is 14,400 trophies.The company normally charges $103 per trophy.Cost data for the current level of production are shown below:  The company has just received a special one-time order for 900 trophies at $48 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

The company has just received a special one-time order for 900 trophies at $48 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

Required:

Should the company accept this special order? Why?

Variable Selling

Costs related to selling that vary with sales activity, such as sales commission.

Fixed Costs

Fixed costs are business expenses that do not change in proportion to the volume of goods or services produced or sold.

- Examine unique orders and assess their economic consequences.

Verified Answer

ZZ

Zhanghao ZhangMay 19, 2024

Final Answer :

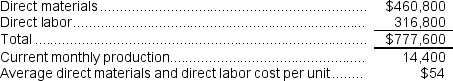

Only the direct materials and direct labor costs are relevant in this decision.To make the decision, we must compute the average direct materials and direct labor cost per unit.  Because the price on the special order is $48 per trophy and the relevant cost is $54, the company would suffer a loss of $6 per trophy.Therefore, the special order should not be accepted.

Because the price on the special order is $48 per trophy and the relevant cost is $54, the company would suffer a loss of $6 per trophy.Therefore, the special order should not be accepted.

Because the price on the special order is $48 per trophy and the relevant cost is $54, the company would suffer a loss of $6 per trophy.Therefore, the special order should not be accepted.

Because the price on the special order is $48 per trophy and the relevant cost is $54, the company would suffer a loss of $6 per trophy.Therefore, the special order should not be accepted.

Learning Objectives

- Examine unique orders and assess their economic consequences.