Asked by Teniqua Westry on May 16, 2024

Verified

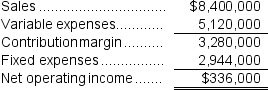

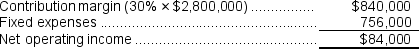

Tadman Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 1.0%

B) 3.0%

C) 5.0%

D) 3.8%

Combined Margin

The total margin that results from combining the gross margin and net margin of a company.

Contribution Margin Ratio

A financial metric that shows the percentage of sales revenue that is not consumed by variable costs and contributes to covering fixed costs.

Fixed Expenses

Costs that do not vary with the level of production or sales, such as rent, salaries, and insurance.

- Gain insight into and determine the margin relevant to investment opportunities.

- Examine the combined contribution of several investment prospects to the company's comprehensive performance.

Verified Answer

JI

Jaylon IngramMay 23, 2024

Final Answer :

D

Explanation :  Net operating income = $336,000 + $84,000 = $420,000

Net operating income = $336,000 + $84,000 = $420,000

Sales = $8,400,000 + $2,800,000 = $11,200,000

Margin = Net operating income ÷ Sales = $420,000 ÷ $11,200,000 = 3.8%

Net operating income = $336,000 + $84,000 = $420,000

Net operating income = $336,000 + $84,000 = $420,000Sales = $8,400,000 + $2,800,000 = $11,200,000

Margin = Net operating income ÷ Sales = $420,000 ÷ $11,200,000 = 3.8%

Learning Objectives

- Gain insight into and determine the margin relevant to investment opportunities.

- Examine the combined contribution of several investment prospects to the company's comprehensive performance.