Asked by Salli Braswell on Jun 17, 2024

Verified

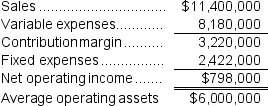

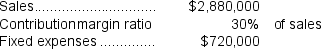

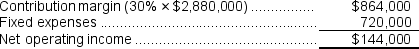

Beery Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 12%.If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

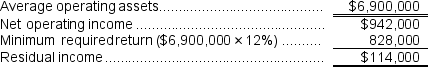

The company's minimum required rate of return is 12%.If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $848,700

B) $942,000

C) $24,300

D) $114,000

Combined Residual Income

The total leftover income from various projects or divisions after accounting for required rate of return or capital costs.

Required Rate Of Return

The minimum expected yield by investors to justify the risk of an investment.

Investment Opportunity

An investment opportunity refers to potentially lucrative financial ventures or assets that individuals or entities can invest in, aiming for future monetary returns.

- Determine and explicate the residual income from a provided financial dataset.

- Appraise the integrated effect of multiple investment avenues on the total performance of the company.

Verified Answer

MM

Maurisio MartinezJun 19, 2024

Final Answer :

D

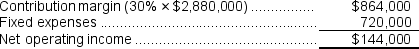

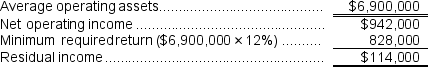

Explanation :  Net operating income = $798,000 + $144,000 = $942,000

Net operating income = $798,000 + $144,000 = $942,000

Average operating assets = $6,000,000 + $900,000 = $6,900,000

Net operating income = $798,000 + $144,000 = $942,000

Net operating income = $798,000 + $144,000 = $942,000Average operating assets = $6,000,000 + $900,000 = $6,900,000

Learning Objectives

- Determine and explicate the residual income from a provided financial dataset.

- Appraise the integrated effect of multiple investment avenues on the total performance of the company.