Asked by Jerry Kpasie on Jun 05, 2024

Verified

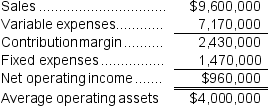

Canedo Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

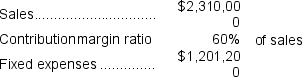

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A) 2.98

B) 17.01

C) 2.53

D) 2.04

Combined Turnover

The sum total of sales or revenues generated by different segments, departments, or subsidiaries of a company within a specified period.

Investment Opportunity

An option available to individuals or companies to invest capital with the expectation of generating a return.

- Familiarize oneself with the concept of turnover among investment opportunities.

- Investigate the aggregate effect of diverse investment opportunities on corporate performance overall.

Verified Answer

KW

Khyati WadhwaJun 12, 2024

Final Answer :

C

Explanation :

To calculate the combined turnover for the entire company, we need to add the turnover from last year's operations to the turnover generated by the investment opportunity.

Turnover from last year's operations = $11,000,000

Turnover generated by the investment opportunity = $700,000 x 3.6 = $2,520,000

Therefore, the combined turnover for the entire company = $11,000,000 + $2,520,000 = $13,520,000

Now, we need to divide this combined turnover by the amount of Canedo's assets to see if the company is using its assets efficiently.

Total assets = $5,000,000

Asset turnover ratio = Combined turnover / Total assets = $13,520,000 / $5,000,000 = 2.704

Therefore, the closest answer is C) 2.53.

Turnover from last year's operations = $11,000,000

Turnover generated by the investment opportunity = $700,000 x 3.6 = $2,520,000

Therefore, the combined turnover for the entire company = $11,000,000 + $2,520,000 = $13,520,000

Now, we need to divide this combined turnover by the amount of Canedo's assets to see if the company is using its assets efficiently.

Total assets = $5,000,000

Asset turnover ratio = Combined turnover / Total assets = $13,520,000 / $5,000,000 = 2.704

Therefore, the closest answer is C) 2.53.

Explanation :

Sales = $9,600,000 + $2,310,000 = $11,910,000

Average operating assets = $4,000,000 + $700,000 = $4,700,000

Turnover = Sales ÷ Average operating assets = $11,910,000 ÷ $4,700,000 = 2.53

Average operating assets = $4,000,000 + $700,000 = $4,700,000

Turnover = Sales ÷ Average operating assets = $11,910,000 ÷ $4,700,000 = 2.53

Learning Objectives

- Familiarize oneself with the concept of turnover among investment opportunities.

- Investigate the aggregate effect of diverse investment opportunities on corporate performance overall.