Asked by Madison Bradford on May 22, 2024

Verified

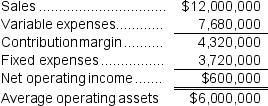

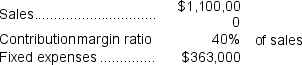

Condren Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A) 1.1%

B) 8.6%

C) 9.7%

D) 11.3%

Combined ROI

A measure of the total return on investment from multiple investments or projects, combined into one metric.

Investment Opportunity

An item or asset obtained with the intention of producing income or increasing in value.

- Investigate the ROI for various business scenarios.

- Evaluate the combined effect of multiple investment opportunities on overall company performance.

Verified Answer

DO

doris okoawohMay 27, 2024

Final Answer :

C

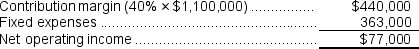

Explanation :  Net operating income = $600,000 + $77,000 = $677,000

Net operating income = $600,000 + $77,000 = $677,000

Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

ROI = Net operating income ÷ Average operating assets = $677,000 ÷ $7,000,000 = 9.7%

Net operating income = $600,000 + $77,000 = $677,000

Net operating income = $600,000 + $77,000 = $677,000Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

ROI = Net operating income ÷ Average operating assets = $677,000 ÷ $7,000,000 = 9.7%

Learning Objectives

- Investigate the ROI for various business scenarios.

- Evaluate the combined effect of multiple investment opportunities on overall company performance.