Asked by Diana Stevenson on Jul 06, 2024

Verified

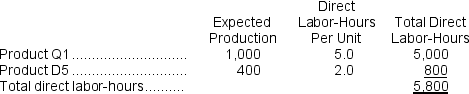

Lefave, Inc., manufactures and sells two products: Product Q1 and Product D5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

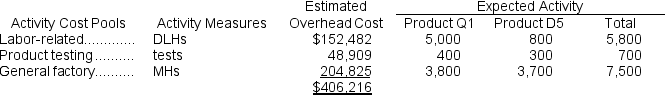

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

A) $26.29 per DLH

B) $70.04 per DLH

C) $69.87 per DLH

D) $27.31 per DLH

Product Q1

Designates the first quarter's product or output in a company's fiscal year.

- Ascertain rates of overhead and put this information to use in evaluating costs for products under Activity-Based Costing.

- Develop an understanding of how to allocate overhead expenses through diverse activity drivers.

Verified Answer

YH

Yanet HernandezJul 07, 2024

Final Answer :

B

Explanation :

To calculate the predetermined overhead rate using the traditional costing method, we need to divide the estimated total overhead costs by the estimated total direct labor-hours:

$9,018,000 / 128,850 DLHs = $70.04 per DLH

Therefore, the closest option is B) $70.04 per DLH.

$9,018,000 / 128,850 DLHs = $70.04 per DLH

Therefore, the closest option is B) $70.04 per DLH.

Explanation :

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $406,216 ÷ 5,800 DLHs = $70.04 per DLH (rounded)

= $406,216 ÷ 5,800 DLHs = $70.04 per DLH (rounded)

Learning Objectives

- Ascertain rates of overhead and put this information to use in evaluating costs for products under Activity-Based Costing.

- Develop an understanding of how to allocate overhead expenses through diverse activity drivers.