Asked by Sandy Babbie on Jul 11, 2024

Verified

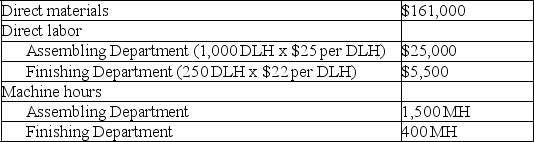

Slosh,Inc.produces washing machines that require two processes,assembling and finishing,to complete.The company's bestselling machine is the commercial washer.Information related to the 500 commercial washers produced annually is shown below.

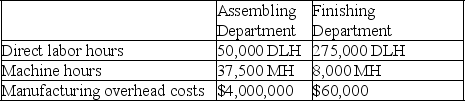

Slosh's total expected overhead costs and related overhead data are shown below.The company uses departmental overhead rates based on direct labor hours in the Assembling Department and machine hours in the Finishing Department.

Slosh's total expected overhead costs and related overhead data are shown below.The company uses departmental overhead rates based on direct labor hours in the Assembling Department and machine hours in the Finishing Department.

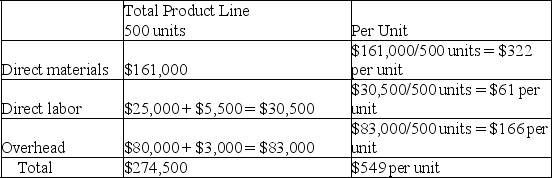

Determine the total product cost of this product line and each individual commercial washer.

Determine the total product cost of this product line and each individual commercial washer.

Departmental Overhead Rates

Overhead rates calculated for specific departments within a company, allowing for more accurate assignment of overhead costs to products.

Direct Labor Hours

The total hours worked by employees directly involved in the production process.

Machine Hours

A measure of the total time that a machine is operated, used in calculating manufacturing costs and allocating expenses.

- Absorb and apply the theory behind departmental overhead rates.

- Analyze the entire cost of production and the cost for each unit for certain product lines.

Verified Answer

$80 per DLH x 1,000 DLH = $80,000 for commercial washer product line

Finishing Dept.overhead: $60,000/8,000 MH = $7.50 per MH

$7.50 per MH x 400 MH = $3,000 for commercial washer product line

Learning Objectives

- Absorb and apply the theory behind departmental overhead rates.

- Analyze the entire cost of production and the cost for each unit for certain product lines.

Related questions

The Departmental Overhead Rate Method Allows Each Department to Have ...

A Company Has Two Products: Big and Little ...

Vasilopoulos Corporation Has Two Production Departments, Casting and Assembly ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...