Asked by Robert Pesta on May 08, 2024

Verified

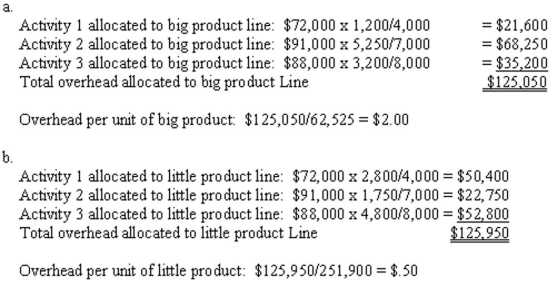

A company has two products: Big and Little.It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:

Annual production and sales level of big product is 62,525 units,and the annual production and sales level of little product is 251,900 units.

Annual production and sales level of big product is 62,525 units,and the annual production and sales level of little product is 251,900 units.

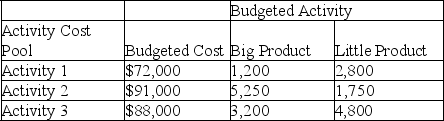

a.Compute the approximate overhead cost per unit of big product under activity-based costing.

b.Compute the approximate overhead cost per unit of little product under activity-based costing.

Activity-Based Costing

A costing methodology that assigns costs to products and services based on the activities and resources that go into producing them.

Overhead Cost Per Unit

The indirect manufacturing costs allocated to each unit of product produced.

- Gain an understanding of and perform calculations for activity-based costing.

- Calculate the aggregate cost of goods produced and the cost per unit for distinct product lines.

Verified Answer

LS

Learning Objectives

- Gain an understanding of and perform calculations for activity-based costing.

- Calculate the aggregate cost of goods produced and the cost per unit for distinct product lines.

Related questions

Assume New Belgium Brewing Company Manufactures and Distributes Three Types ...

Fischer Company Identified the Following Activities,costs,and Activity Drivers ...

Slosh,IncProduces Washing Machines That Require Two Processes,assembling and Finishing,to Complete ...

Bark Mode,Incorporated Produces and Distributes Two Types of Security Systems,Standard ...

A Company Uses Activity-Based Costing to Determine the Costs of ...