Asked by Ashley Friend on Jul 12, 2024

Verified

Sefcovic Enterprises LLC recorded the following transactions for the just completed month. The company had no beginning inventories.

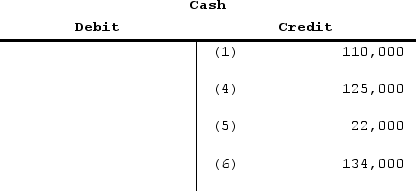

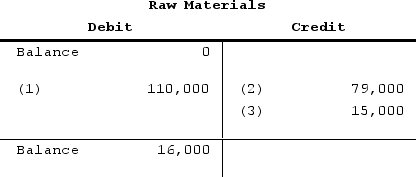

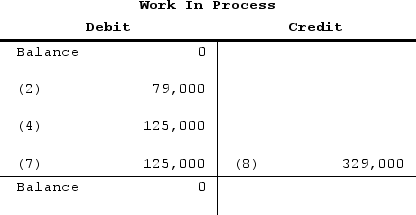

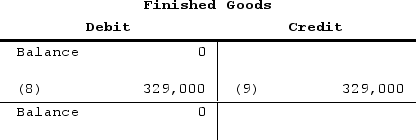

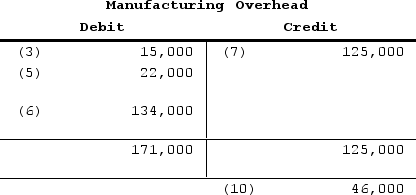

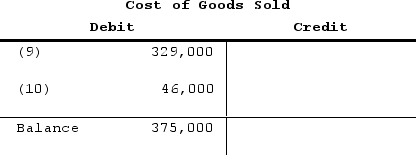

(1) Raw materials purchased for cash, $110,000(2) Direct materials requisitioned for use in production, $79,000(3) Indirect materials requisitioned for use in production, $15,000(4) Direct labor wages incurred and paid, $125,000(5) Indirect labor wages incurred and paid, $22,000(6) Additional manufacturing overhead costs incurred and paid, $134,000(7) Manufacturing overhead costs applied to jobs, $125,000(8) All of the jobs in process were completed.(9) All of the completed jobs were shipped to customers.(10) Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold.

Required:

a. Post the above transactions to the T-accounts: b. Determine the adjusted cost of goods sold for the month.

Raw Materials

Fundamental substances employed in the creation of manufactured products.

Direct Materials

Materials that can be directly linked to the manufacturing of a particular product.

Manufacturing Overhead

Costs in manufacturing beyond direct labor and materials, including expenses like factory maintenance and equipment depreciation, essential for production but not directly traceable to specific units.

- Familiarize oneself with the parts and calculations associated with a job-order costing system.

- Calculate the established overhead rate and apportion manufacturing overhead to job orders.

- Draft journal entries for events relating to job-order costing systems, including the handling of raw materials, labor, and overhead.

Verified Answer

</div><div style=" vertical-align: top;display: inline-block;">

</div><div style=" vertical-align: top;display: inline-block;"> </div><div style=" vertical-align: top;display: inline-block;">

</div><div style=" vertical-align: top;display: inline-block;"> </div><div style=" vertical-align: top;display: inline-block;">

</div><div style=" vertical-align: top;display: inline-block;"> </div><div style=" vertical-align: top;display: inline-block;">

</div><div style=" vertical-align: top;display: inline-block;"> </div><div style=" vertical-align: top;display: inline-block;">

</div><div style=" vertical-align: top;display: inline-block;"> b. The adjusted cost of goods sold is the ending balance of $375,000 in the Cost of Goods Sold account.

b. The adjusted cost of goods sold is the ending balance of $375,000 in the Cost of Goods Sold account.

Learning Objectives

- Familiarize oneself with the parts and calculations associated with a job-order costing system.

- Calculate the established overhead rate and apportion manufacturing overhead to job orders.

- Draft journal entries for events relating to job-order costing systems, including the handling of raw materials, labor, and overhead.

Related questions

During December, Moulding Corporation Incurred $76,000 of Actual Manufacturing Overhead ...

Baab Corporation Is a Manufacturing Firm That Uses Job-Order Costing ...

During May, Sharpton Corporation Recorded the Following ...

Ellithorpe Corporation Has Provided the Following Data Concerning Last Month's ...

Baab Corporation Is a Manufacturing Firm That Uses Job-Order Costing ...