Asked by Cydney Adger on May 03, 2024

Verified

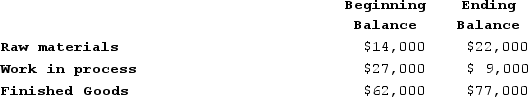

Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year:

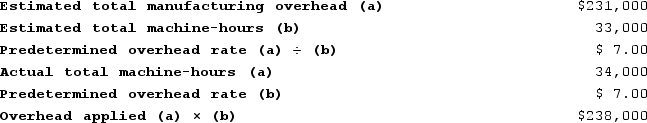

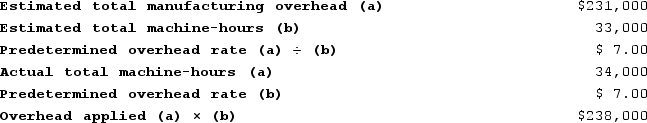

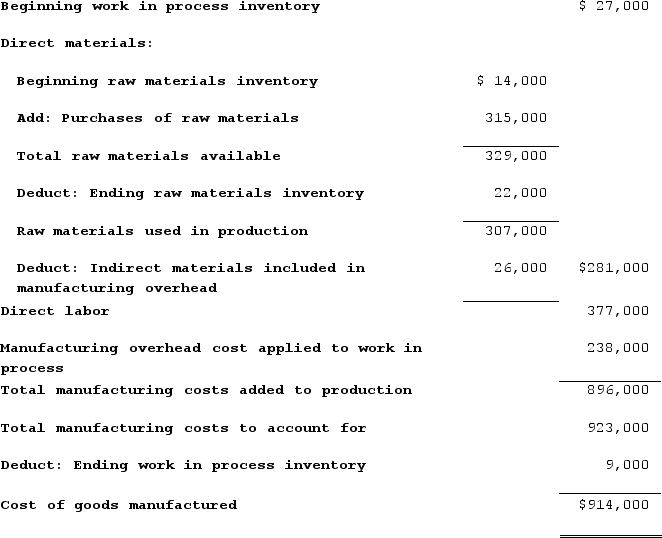

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year: Raw materials were purchased, $315,000.Raw materials were requisitioned for use in production, $307,000 ($281,000 direct and $26,000 indirect).The following employee costs were incurred: direct labor, $377,000; indirect labor, $96,000; and administrative salaries, $172,000.Selling costs, $147,000.Factory utility costs, $10,000.Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling, general, and administrative activities.Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34,000 machine-hours.Sales for the year totaled $1,253,000.Required:a. Prepare a schedule of cost of goods manufactured.b. Was the overhead underapplied or overapplied? By how much?c. Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year: Raw materials were purchased, $315,000.Raw materials were requisitioned for use in production, $307,000 ($281,000 direct and $26,000 indirect).The following employee costs were incurred: direct labor, $377,000; indirect labor, $96,000; and administrative salaries, $172,000.Selling costs, $147,000.Factory utility costs, $10,000.Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling, general, and administrative activities.Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34,000 machine-hours.Sales for the year totaled $1,253,000.Required:a. Prepare a schedule of cost of goods manufactured.b. Was the overhead underapplied or overapplied? By how much?c. Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Predetermined Overhead Rate

A rate calculated before a period begins, used to allocate projected overhead costs to products or services based on a chosen activity base.

Raw Materials

The basic substances or components that are used in the manufacturing process to produce finished goods.

- Ascertain the predetermined overhead rate and distribute manufacturing overhead across job tasks.

- Determine the incidence of underapplied or overapplied manufacturing overhead and examine its impact on finances.

- Prepare income statements incorporating job-order costing information.

Verified Answer

RH

Raymone HardingMay 08, 2024

Final Answer :

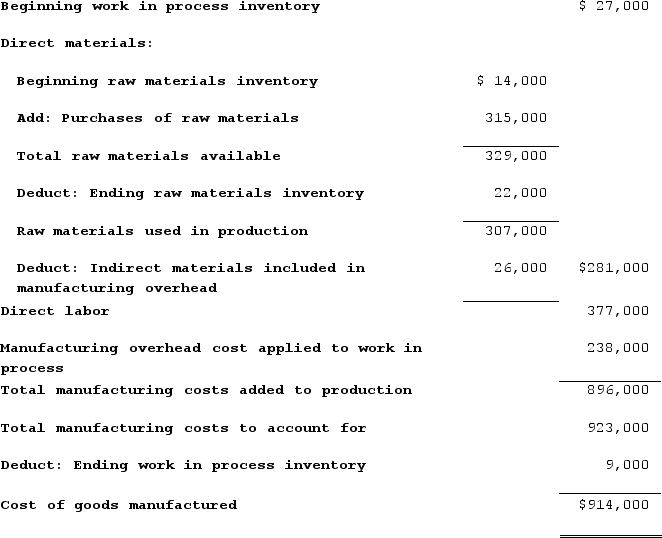

a.Schedule of cost of goods manufactured

Cost of Goods Manufactured

Cost of Goods Manufactured

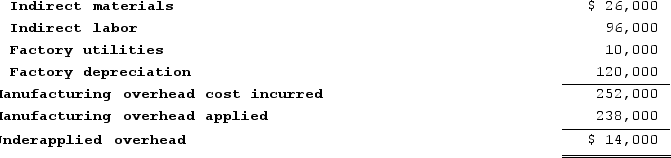

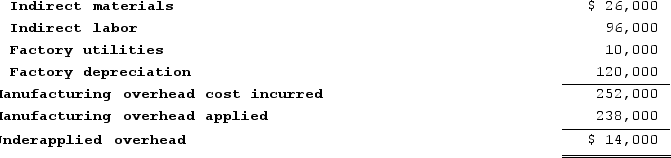

b.Overhead underapplied or overappliedActual manufacturing overhead cost incurred:

b.Overhead underapplied or overappliedActual manufacturing overhead cost incurred:

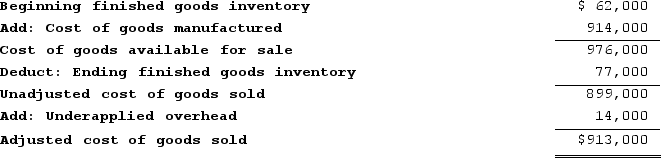

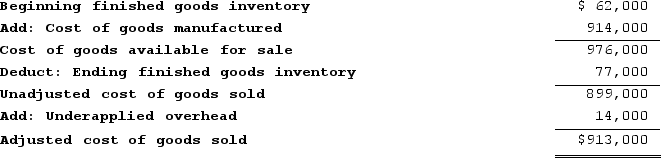

c.Income StatementCost of Goods Sold

c.Income StatementCost of Goods Sold

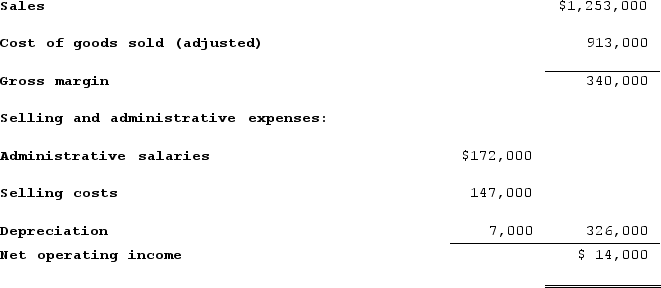

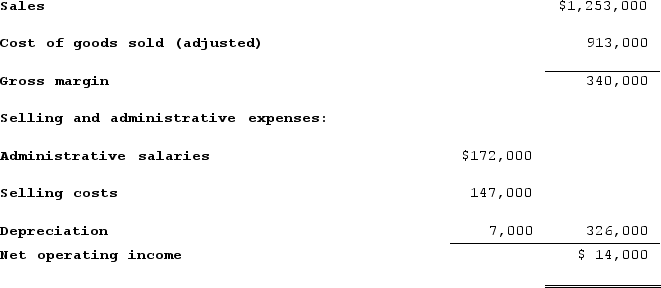

Income Statement

Income Statement

Cost of Goods Manufactured

Cost of Goods Manufactured b.Overhead underapplied or overappliedActual manufacturing overhead cost incurred:

b.Overhead underapplied or overappliedActual manufacturing overhead cost incurred: c.Income StatementCost of Goods Sold

c.Income StatementCost of Goods Sold Income Statement

Income Statement

Learning Objectives

- Ascertain the predetermined overhead rate and distribute manufacturing overhead across job tasks.

- Determine the incidence of underapplied or overapplied manufacturing overhead and examine its impact on finances.

- Prepare income statements incorporating job-order costing information.

Related questions

Sefcovic Enterprises LLC Recorded the Following Transactions for the Just ...

During December, Moulding Corporation Incurred $76,000 of Actual Manufacturing Overhead ...

Ellithorpe Corporation Has Provided the Following Data Concerning Last Month's ...

Testor Products Uses a Job-Order Costing System with a Predetermined ...

Baab Corporation Is a Manufacturing Firm That Uses Job-Order Costing ...