Asked by Bailey Glover on Jul 12, 2024

Verified

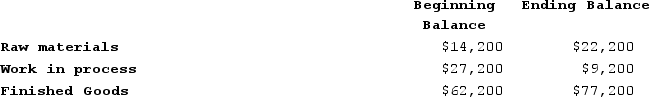

Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year:

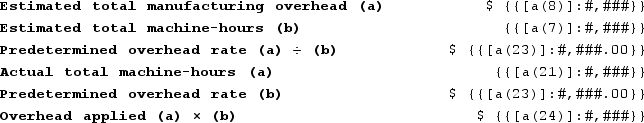

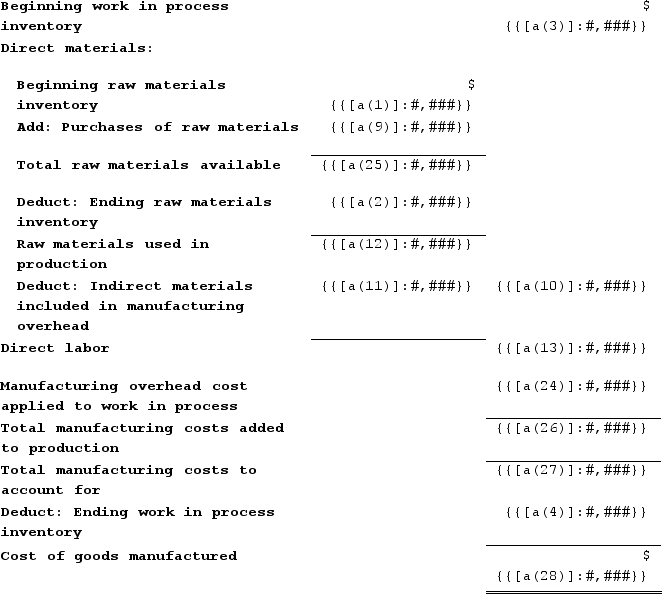

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,200 machine-hours and incur $245,680 in manufacturing overhead cost. The following transactions were recorded for the year:Raw materials were purchased, $315,200.Raw materials were requisitioned for use in production, $307,200 ($280,800 direct and $26,400 indirect).The following employee costs were incurred: direct labor, $377,200; indirect labor, $96,200; and administrative salaries, $172,200.Selling costs, $147,200.Factory utility costs, $10,200.Depreciation for the year was $139,000 of which $120,400 is related to factory operations and $18,600 is related to selling, general, and administrative activities.Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34,040 machine-hours.Sales for the year totaled $1,261,000.Required:a. Prepare a schedule of cost of goods manufactured.b. Was the overhead underapplied or overapplied? By how much?c. Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,200 machine-hours and incur $245,680 in manufacturing overhead cost. The following transactions were recorded for the year:Raw materials were purchased, $315,200.Raw materials were requisitioned for use in production, $307,200 ($280,800 direct and $26,400 indirect).The following employee costs were incurred: direct labor, $377,200; indirect labor, $96,200; and administrative salaries, $172,200.Selling costs, $147,200.Factory utility costs, $10,200.Depreciation for the year was $139,000 of which $120,400 is related to factory operations and $18,600 is related to selling, general, and administrative activities.Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34,040 machine-hours.Sales for the year totaled $1,261,000.Required:a. Prepare a schedule of cost of goods manufactured.b. Was the overhead underapplied or overapplied? By how much?c. Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Predetermined Overhead Rate

A rate calculated before the accounting period begins, used to allocate manufacturing overhead to individual jobs.

Machine-Hours

A unit of measurement for production capacity, indicating the total number of hours that machinery is operational during a given period.

Raw Materials

Basic substances in their natural, modified, or semi-processed state, used as inputs to production or manufacturing.

- Compute the predetermined overhead rate and allocate manufacturing overhead to work assignments.

- Assess and scrutinize the status of manufacturing overhead as either underapplied or overapplied, including its financial repercussions.

- Develop income statements that include information from job-order costing systems.

Verified Answer

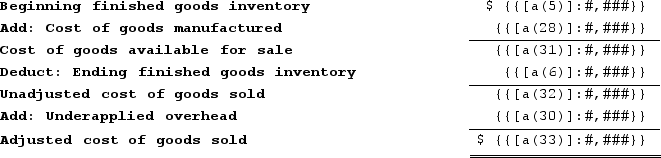

Cost of Goods Manufactured

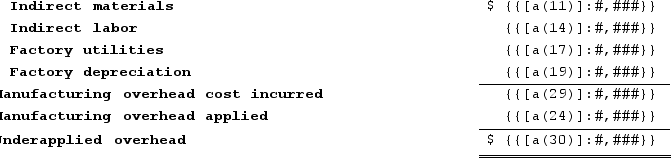

Cost of Goods Manufactured b. Overhead underapplied or overappliedActual manufacturing overhead cost incurred:

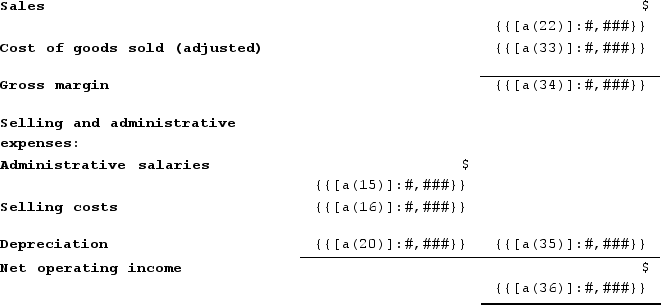

b. Overhead underapplied or overappliedActual manufacturing overhead cost incurred: c.Income StatementCost of Goods Sold

c.Income StatementCost of Goods Sold Income Statement

Income Statement

Learning Objectives

- Compute the predetermined overhead rate and allocate manufacturing overhead to work assignments.

- Assess and scrutinize the status of manufacturing overhead as either underapplied or overapplied, including its financial repercussions.

- Develop income statements that include information from job-order costing systems.

Related questions

Baab Corporation Is a Manufacturing Firm That Uses Job-Order Costing ...

During December, Moulding Corporation Incurred $76,000 of Actual Manufacturing Overhead ...

Sefcovic Enterprises LLC Recorded the Following Transactions for the Just ...

Testor Products Uses a Job-Order Costing System with a Predetermined ...

Ellithorpe Corporation Has Provided the Following Data Concerning Last Month's ...