Asked by Jordan Prather on Jul 12, 2024

Verified

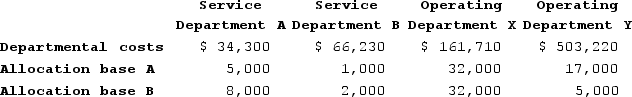

Sandven Corporation uses the direct method to allocate its two service department costs to its two operating departments. Data concerning those departments follow:

Service Department A costs are allocated on the basis of allocation base A and Service Department B costs are allocated on the basis of allocation base B.Required:Allocate the service department costs to the operating departments using the direct method.

Service Department A costs are allocated on the basis of allocation base A and Service Department B costs are allocated on the basis of allocation base B.Required:Allocate the service department costs to the operating departments using the direct method.

Direct Method

A cost allocation method that assigns service department costs directly to production departments without any intermediary allocations.

Service Department Costs

Expenses associated with departments that do not directly produce goods but provide essential services to those that do, like maintenance and security.

- Contrast the direct method with various strategies for distributing costs from service departments to operating units.

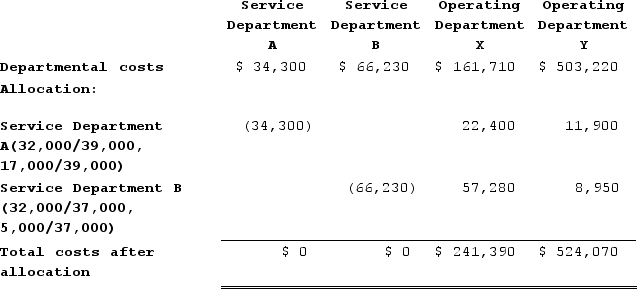

Verified Answer

Allocation base for Service Department B costs = 32,000 + 5,000 = 37,000

Learning Objectives

- Contrast the direct method with various strategies for distributing costs from service departments to operating units.

Related questions

Stoltz Corporation Uses the Direct Method to Allocate Service Department ...

Alpha Manufacturing Corporation Has Two Service Departments, Custodial Services and ...

Anchor Corporation Has Two Service Departments, Personnel and Engineering, and ...

San Juan Minerals (SJM) Has Two Service Departments and Two ...

In Both the Direct and Step-Down Methods of Allocating Service ...